8 Best Digital Financial Wellness Tools for Employees in 2024

Discover the top 8 digital financial wellness tools that empower employees to improve their financial health and well-being in 2024.

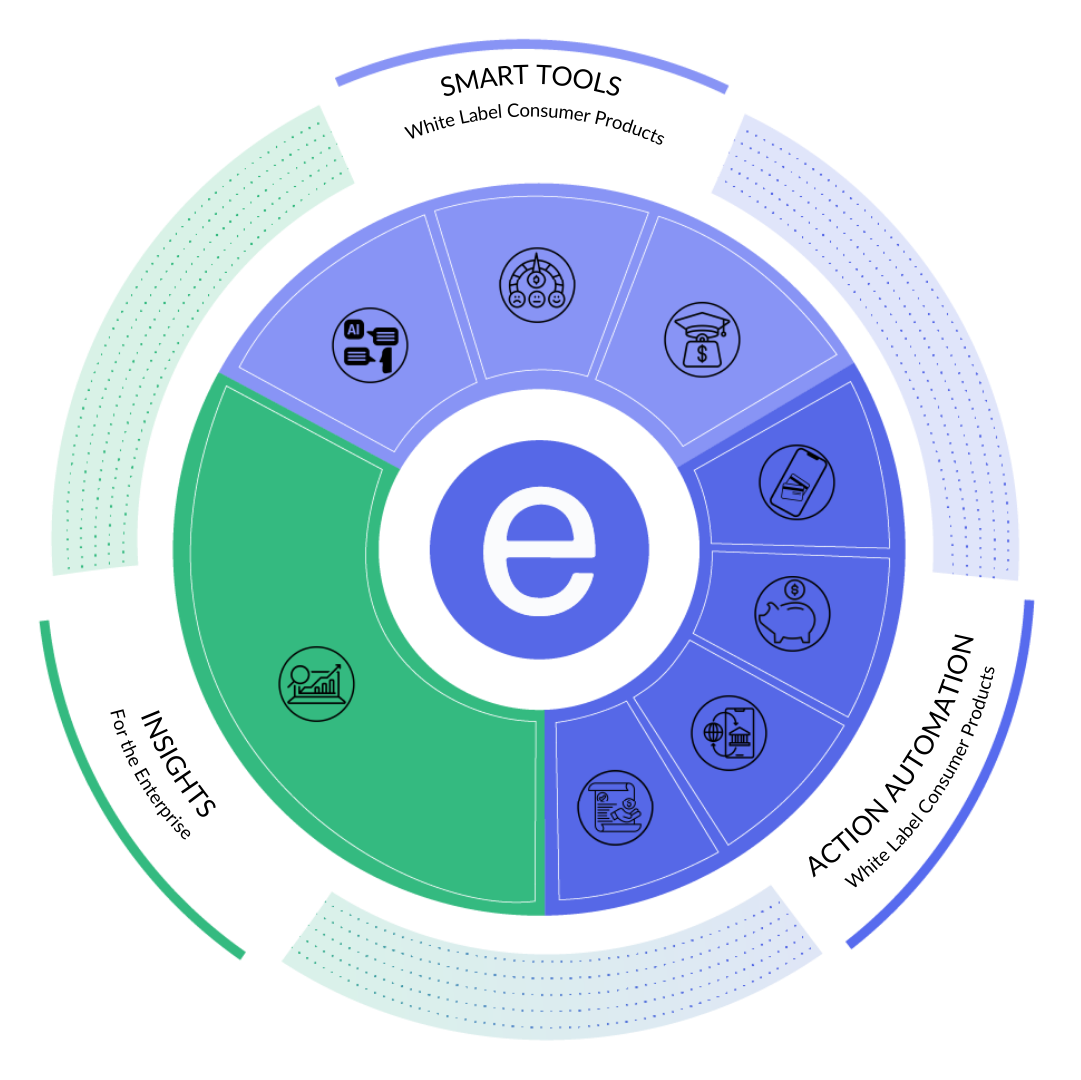

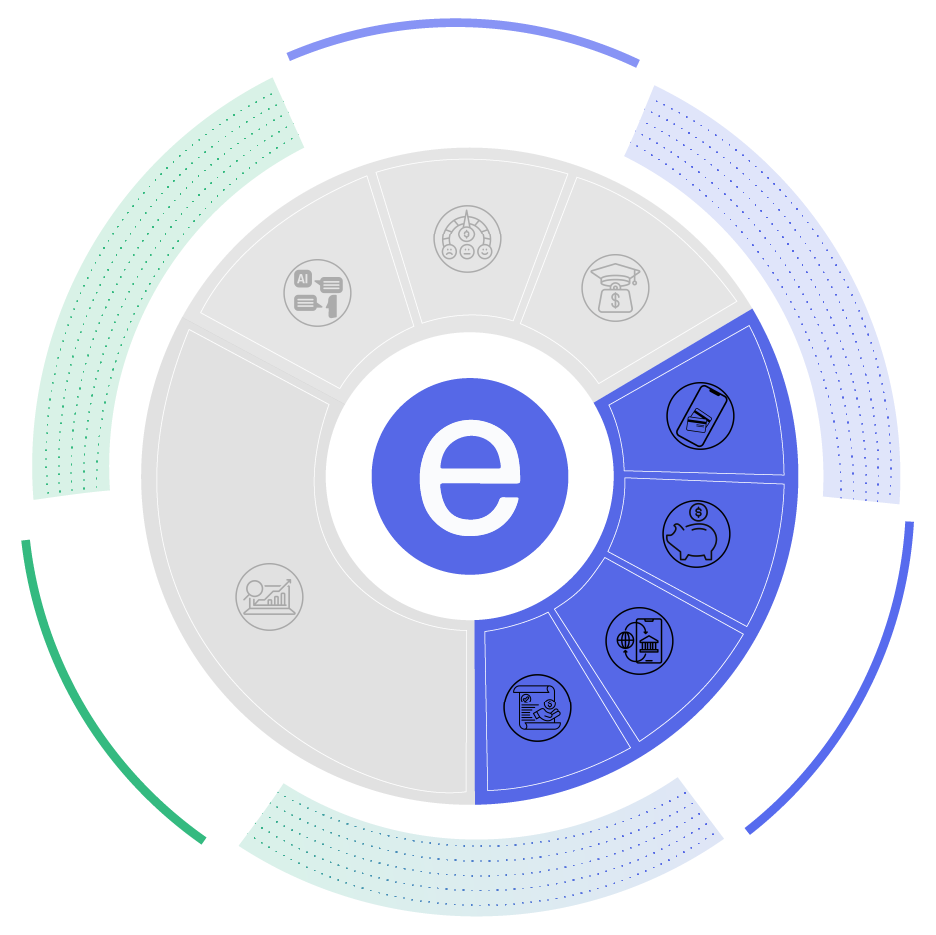

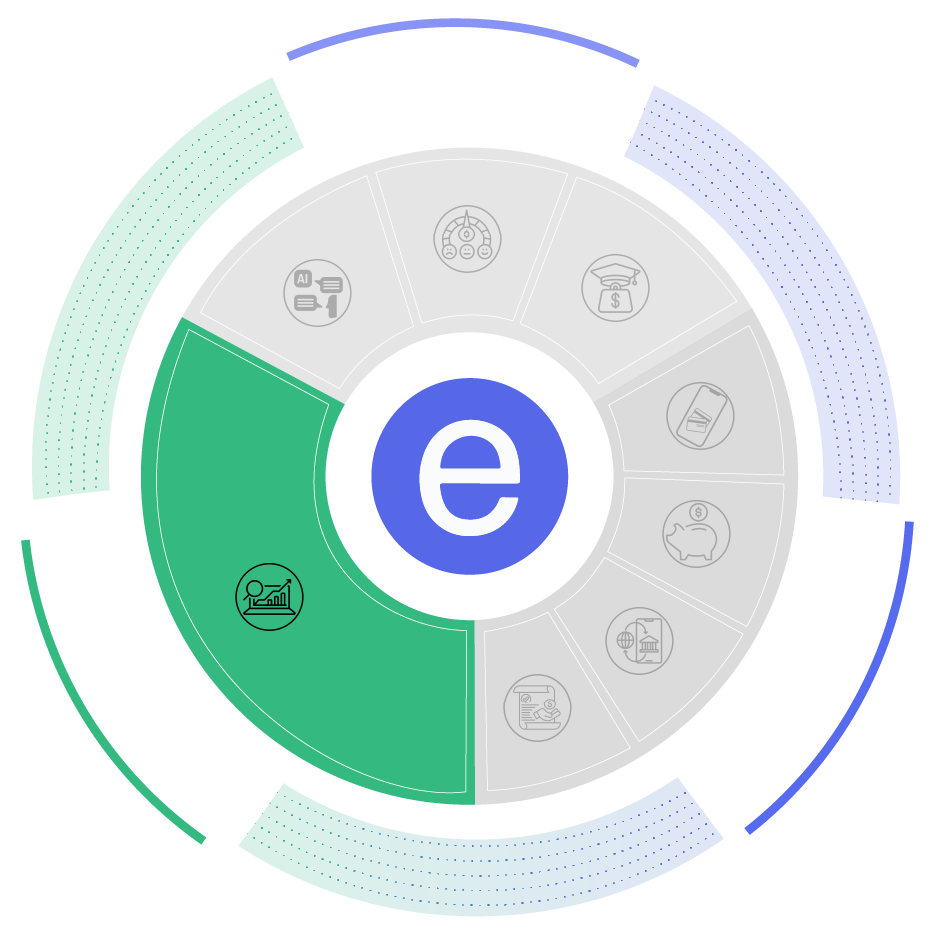

The Platform

Our AI-powered Financial Stability Automation Platform represents a breakthrough in holistic, dynamic financial wellness tools.

Smart Tools • Action Automation • Insights

Help clients remove the stress from budgeting and debt management. Our hyper-personalized, contextual, and interactive tools simplify and automate complex financial wellness activities.

The ultimate customer-for-life engagement tool.

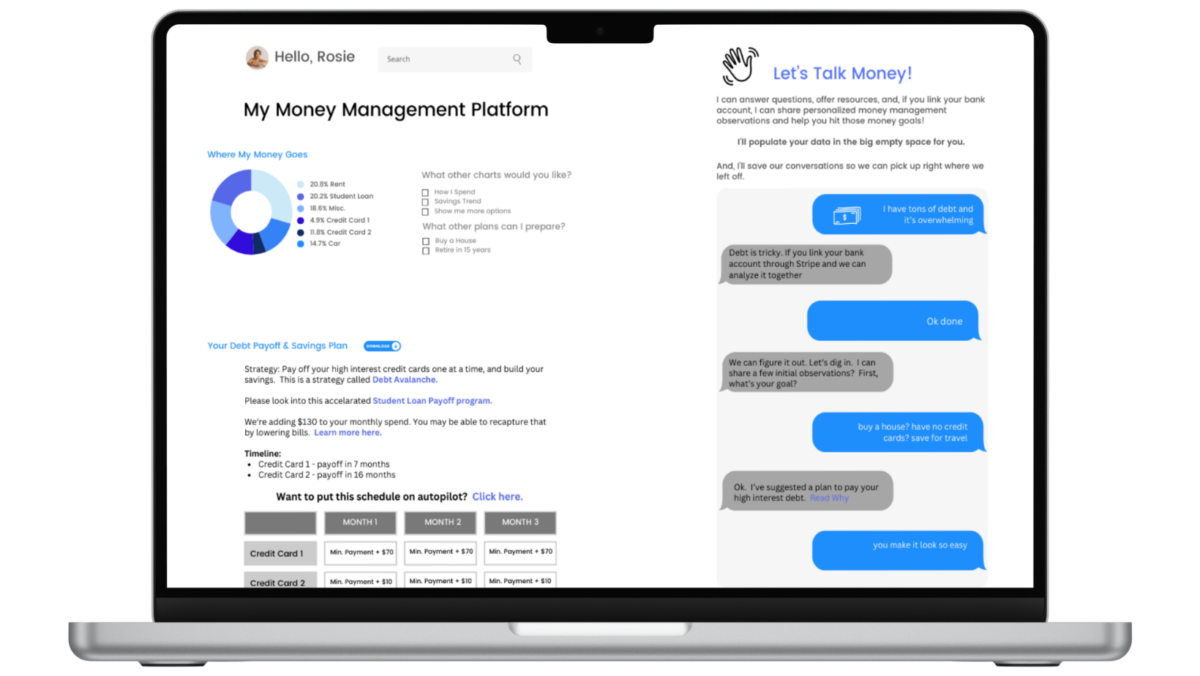

66% of consumers will abandon a brand if they don’t get a personalized experience.¹ Our AI Advisor enables exactly the type of hyper-personalized interactions and tailored experiences that lead to increased customer satisfaction and loyalty.

Our AI Advisor is a personal finance expert, capable of conducting complex tasks, including:

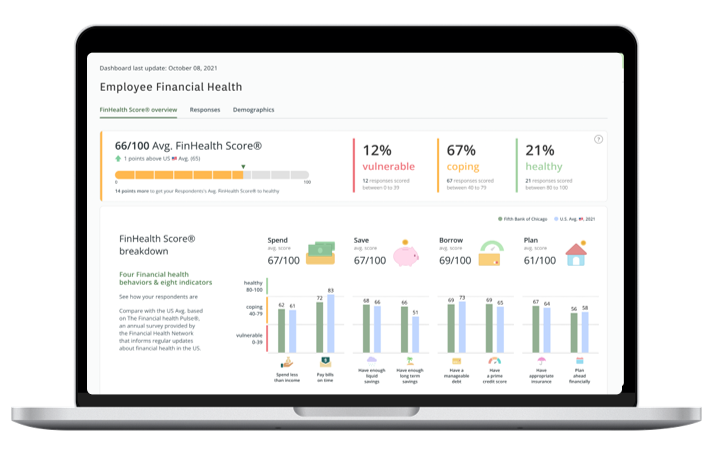

The Financial Health Score® is a scientifically developed financial health assessment quiz.

Give your users the ability to confidentially self-assess and benchmark their financial health to guide their progress.

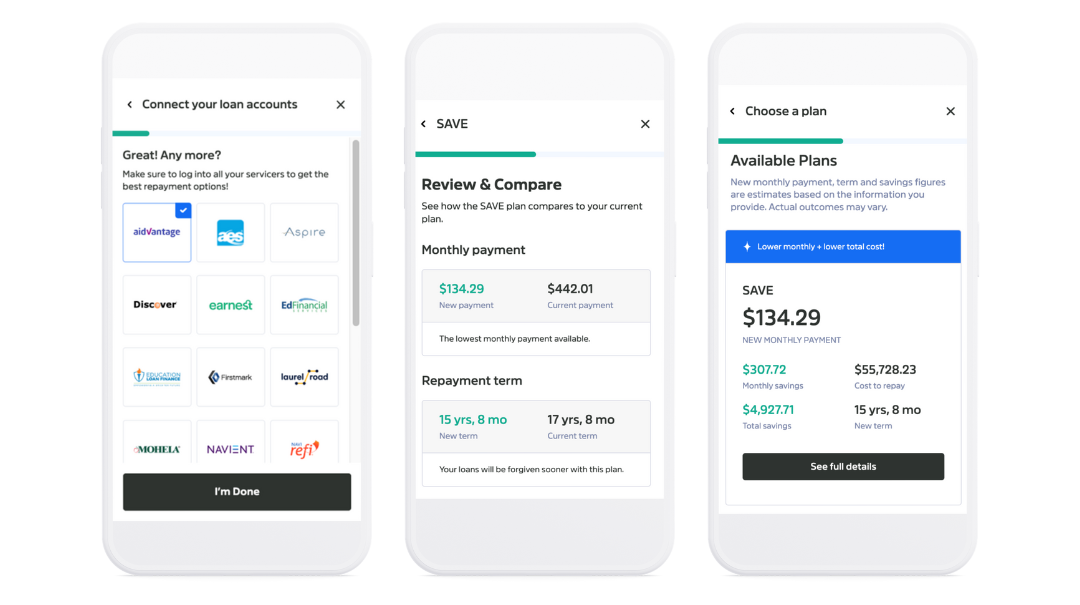

Locate open student loans and servicers in just a few clicks, then assess eligibility & apply for Federal student loan savings plans

A suite of actionable, intuitive tools that put users in control of budgeting and debt pay down.

With the ability to accept ACH or debit cards, you can accommodate text to pay and provide borrowers with modern communication and payment options.

Launch trigger campaigns at the earliest sign of a late payment to help borrowers avoid late fees. And, provide one-click ability to opt in for automated digital payments via debit card.

Our automated savings builder effortlessly grows savings by transferring manageable amounts to a savings account on a user-defined schedule.

Perfect to support homebuyer readiness programs.

Our automated debt paydown tool provides financially stressed individuals with a structured and manageable way to tackle their debt.

By offering personalized strategies, this tool helps users reduce their debt more efficiently, alleviating stress and improving financial health.

Reduce your monthly expenses and free up cash flow by lowering certain bills and canceling unwanted or unused subscriptions.

Never pay for an unwanted or unused subscription again. Instantly find and track all your subscriptions.

For the Enterprise, a meaningful, differentiated data set that incorporates user intent.

Data that presents a richer financial profile of borrower, including user intent based on their queries.

These unique insights elevate everything from marketing and cross-sell and recapture, and portfolio performance activities.

Discover the top 8 digital financial wellness tools that empower employees to improve their financial health and well-being in 2024.

¹Twillio State of Customer Engagement survey

The Financial Stability Automation Platform is not a substitute for financial advice from a professional who is aware of facts and circumstances for a specific situation, and EarnUp Inc. is not providing any financial advice through the Financial Stability Automation Platform. The Financial Stability Automation platform should not be used to make any credit, lending, or other financial decisions.

AI Advisor is not a substitute for financial advice from a professional who is aware of facts and circumstances for a specific situation, and EarnUp Inc. is not providing any financial advice through AI Advisor. AI Advisor should not be used to make any credit, lending, or other financial decisions.

EarnUp Inc.

2370 Market St Ste 203

San Francisco, CA 94114-1521 USA

800-209-9700

© EarnUp 2024 All Rights Reserved