AI Advisor: Revolutionizing the Mortgage Industry

Discover how AI Advisors are transforming financial management, offering personalized guidance and empowering both professionals and consumers.

AI Advisor automates end-to-end consumer financial wellness, from expert advice to seamless execution.

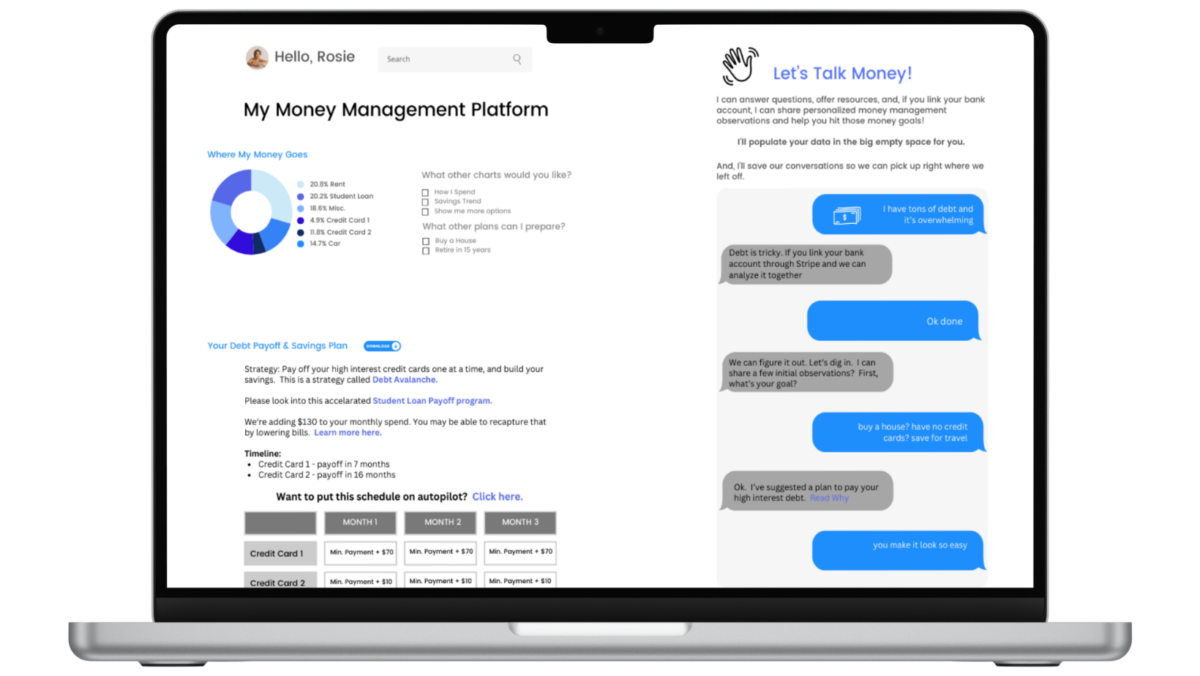

AI Advisor responds to your customer’s complex questions with hyper-personalized advice and useful resources, incorporating real-time banking, debt, credit information, and financial goals.

Powered by sophisticated artificial intelligence, our context-aware conversation agent integrates seamlessly into your existing platform.

What sets AI Advisor apart is the ability to understand and interpret the context of a query and respond with an actionable solution, including product offers such as HELOCs, cards, and consolidation loans.

24/7 access to top-notch advice.

Democratizes access to financial wellness tools with always-on, discreet, and confident money & debt management guidance.

Customer for life engagement.

Analyzes a user’s current financial accounts, forms contextual responses to complex questions, and recommends appropriate products and solutions.

Enables smart, long-term goal attainment.

Delivers smart, actionable resources and recommends tools beyond what a budget-tracking app can provide.

Automate the cross-sell of products being researched, or based on user need

Appeals to a more broad demographic and satisfies expectation on access to service

Reduce burden on customer service agents but maintain a consistent experience for customers

Extends offerings to include professional services and democratizes access to financial expertise

Brand of choice for deposit accounts and creates a level of stickiness that lessens attrition

High engagement levels coupled with valuable information keeps your brand top of mind

Our next-gen conversational AI solution enables frictionless access to information, tools, and products across any device.

While simple chatbots struggle with complex inquiries, our AI-powered conversation agent is well-equipped to handle nuanced financial questions and provide more meaningful interactions and contextual answers.

AI Advisor fosters lifelong connections through highly contextual conversations. It adapts to each user’s unique financial circumstances, goals, and behaviors to deliver personalized advice that keeps them coming back for more.

By helping customers set and achieve their financial goals, AI Advisor becomes an indispensable partner in their journey, naturally establishing long-term loyalty.

This dynamic tool transforms routine financial management into a compelling, interactive experience. It encourages frequent interactions, enhances engagement, and solidifies customer relationships with your institution over time. Through its unique approach, AI Advisor doesn’t just provide advice – it actively builds a sticky, enduring bond between your brand and your customers.

AI Advisor helps both future and previously-denied borrowers automate their path to homeownership with tailored advice and custom action plans to ensure guideline qualification. This includes smart debt paydown and automated savings plans to:

Strategic Debt Guidance

Financial Health Monitoring

Budget Development, Management, & Tracking

Expense Analysis

Financial Guidance

Financial Literacy Improvement

Building AI that does the right thing means crafting systems that behave ethically, openly, and with clear responsibility. Aligning with human values gives AI its moral North Star, preventing deviations from the straight and narrow path. When building AI, fairness is the foundation.

Systems must be blind to bias and loaded with empathy to promote ethical use.

Clear and concise decisions are also a must, with the logic behind them crystal clear. Furthermore, AI needs to be adaptable, overcoming diverse challenges with ease. Lastly, there’s accountability – organizations must answer to their actions.

At the core of responsible AI is the understanding that trust is built on fair treatment, strict adherence to regulations, and proactive risk management. It’s hard to overstate the impact of responsible AI on decision-making – when organizations get it right, they can count on more informed choices and a sizable uptick in user trust and safety.

At EarnUp, we don’t just talk the talk – we walk the walk by establishing clear principles, laying out guidance, setting up governance, and using the right tools to keep everything running smoothly.

Responsible AI lays the groundwork for a more promising tomorrow, where tech integration and daily living peacefully coexist.

Our AI-powered chatbot can access and analyze customers' financial data, including account balances, transaction history, and debt information, which allows for a more personalized and contextual response.

Our AI Advisor uses NLP to better understand complex queries, detect sentiment, and identify user intent. This enables the ability to comprehend context and nuances in customer questions, leading to more accurate responses.

AI Advisor leverages customer data and machine learning algorithms to offer tailored recommendations and financial advice, aligning with users' financial goals and preferences.

Our AI Advisor uses ML algorithms to learn from past interactions and improve over time.

This continuous learning process enhances the ability to handle complex queries and offer relevant suggestions.

AI Advisor works across multiple channels (e.g., websites, mobile apps, messaging platforms) and maintains consistent access to backend systems.

Integration with data analytics platforms enables AI Advisor to gather insights from conversations, helping financial institutions understand customer needs in real-time.

Manage users from a central directory, and present users with a seamless experience.

Deployment options are flexible, and include iFrame and widget.

AI Advisor can handle a large number of users, data, and processes across your organization.

AI Advisor can integrate with your enterprise systems and workflow.

We incorporate robust security features to protect sensitive corporate data and meet compliance requirements.

Your Data Stays Yours and is Not Shared: Your data won’t be used to train other AI models. We ensure transparency, data isolation, and audit logs.

Flexible hosting models: You can host the data and the models in AWS, Azure, or Google Cloud Platform in a private account accessible to only your organization.

All user PII information is encrypted and available only with the access key.

Discover how AI Advisors are transforming financial management, offering personalized guidance and empowering both professionals and consumers.

The Financial Stability Automation Platform is not a substitute for financial advice from a professional who is aware of facts and circumstances for a specific situation, and EarnUp Inc. is not providing any financial advice through the Financial Stability Automation Platform. The Financial Stability Automation platform should not be used to make any credit, lending, or other financial decisions.

AI Advisor is not a substitute for financial advice from a professional who is aware of facts and circumstances for a specific situation, and EarnUp Inc. is not providing any financial advice through AI Advisor. AI Advisor should not be used to make any credit, lending, or other financial decisions.

EarnUp Inc.

2370 Market St Ste 203

San Francisco, CA 94114-1521 USA

800-209-9700

© EarnUp 2025 All Rights Reserved