>3 million people have used our award-winning platform to automatically pay down debt & save for life events.

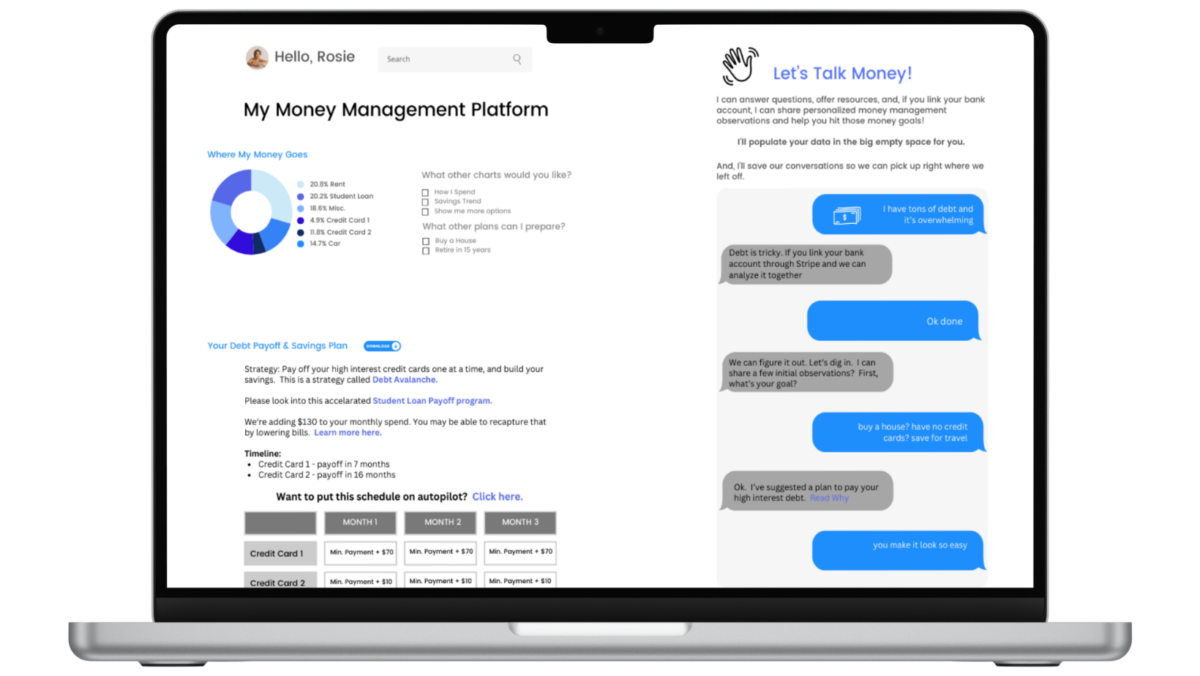

Offer an always-on AI-powered financial genius that automates end-to-end consumer financial wellness, from expert advice to seamless execution.

AI Advisor instantly analyzes the user’s real-time banking and credit data to answer complex financial questions with personalized, actionable answers, including tailored product recommendations.

The ultimate customer engagement tool, with AI Advisor you plug in an artificial intelligence tool that delivers a win-win for you and your customers.

With EarnUp, Lenders, Servicers, and Credit Unions provide dynamic, modern solutions that automate savings and debt paydown activities.

A high-value Engagement Platform

Help people become homebuyer ready, create predictable revenue streams, improve retention, and reduce risk with meaningful engagement.

A turnkey infrastructure levels the playing field

Establish a dynamic, modern Fintech platform to broaden demographic appeal and boost membership.

payments remitted to loan servicers

consumers have used EarnUp

cumulative transactions value

transactions completed

Homeownership remains the American dream, and arguably one of the most reliable ways to build wealth.

Elevated home prices and higher interest rates present challenges to buying a home. To get consumers homebuyer ready, lenders & credit unions implement EarnUp’s Engagement Platform.

As a double bottom line company, we prioritize both financial returns and social impact in our business operations and decision-making. Proud to be backed by:

The Financial Stability Automation Platform is not a substitute for financial advice from a professional who is aware of facts and circumstances for a specific situation, and EarnUp Inc. is not providing any financial advice through the Financial Stability Automation Platform. The Financial Stability Automation platform should not be used to make any credit, lending, or other financial decisions.”

AI Advisor is not a substitute for financial advice from a professional who is aware of facts and circumstances for a specific situation, and EarnUp Inc. is not providing any financial advice through AI Advisor. AI Advisor should not be used to make any credit, lending, or other financial decisions.

EarnUp Inc.

2370 Market St Ste 203

San Francisco, CA 94114-1521 USA

800-209-9700

© EarnUp 2025 All Rights Reserved