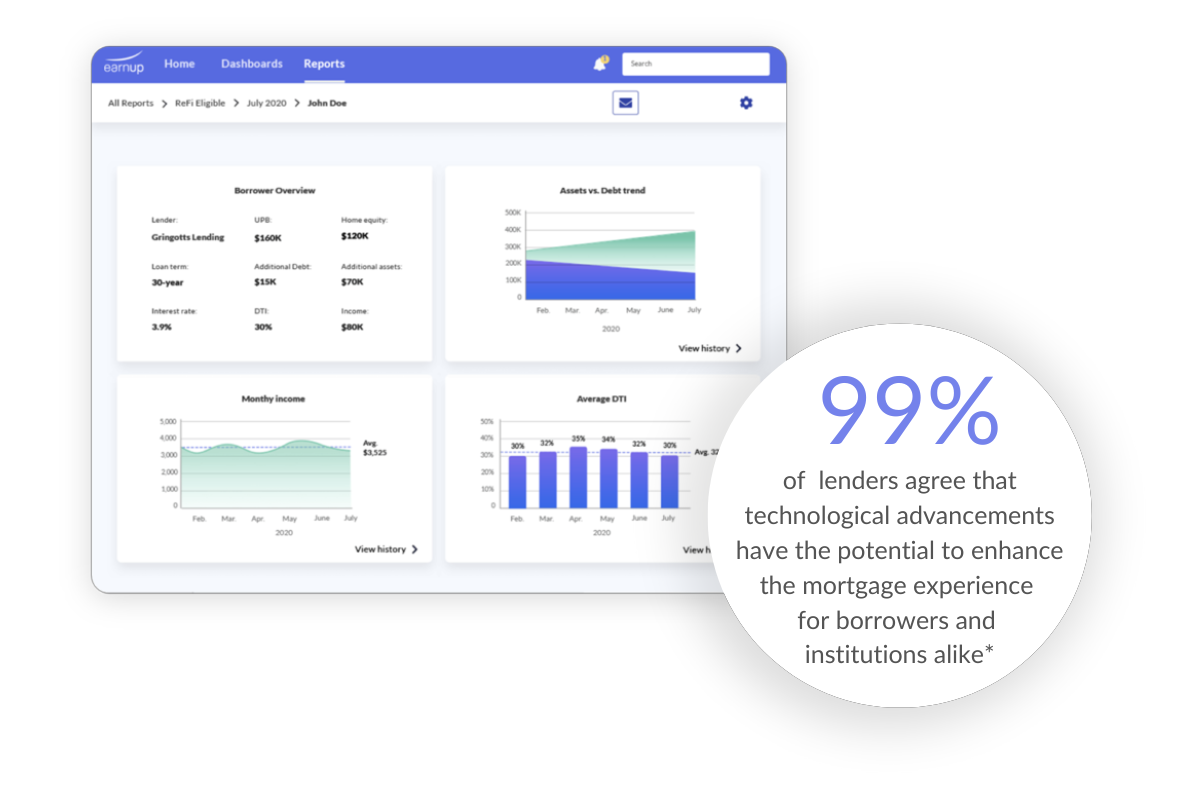

Half of All Loan Applicants Denied Since 2022: Here’s What Mortgage Lenders Should Do Now

Half of Americans who’ve applied for a loan or financial product since March 2022 have been denied. The Consumer Financial Protection Bureau also found that nearly 1 in 4 applicants who were denied (23%) pursued alternative financing