AI services are revolutionizing industries, including financial institutions. More financial institutions are embracing these cutting-edge technologies to streamline operations, enhance customer experiences, and gain a competitive edge. But with the vast array of AI solutions available, businesses, especially financial companies, may find it challenging to figure out how to best leverage them.

Understanding the different types of AI services is critical for success. In this article, we’ll explore AI services for financial companies and cover the various applications, benefits, and considerations of using AI. Let’s explore how AI is reshaping the future of finance.

What are AI Services?

AI services use powerful computer programs that perform tasks typically requiring human intelligence – think AI financial advisor. This isn’t some far-off idea; it’s real.

AI can analyze a customer’s finances and suggest personalized ways to manage their money better. Maybe it finds ways for customers to save more money or helps them understand complicated financial products. That’s the power of AI services. They can analyze large amounts of data, spot trends we might miss, and give us helpful information.

But AI services are more than just financial advisors. They can be used for lots of tasks, like automating customer service, detecting fraud, and even making decisions about loans. This can save companies time and money, but more importantly, it gives customers better, faster, and more personalized experiences.

AI Services for Financial Companies: Reshaping the Financial Landscape

Financial companies are always looking for new ways to improve their bottom line and better serve their clients. AI services offer these companies the opportunity to gain a competitive advantage. AI can automate tasks, improve decision-making, and deliver hyper-personalized customer experiences. But with so many options available, it’s important to understand which AI service best aligns with your business needs.

Revolutionizing Customer Service with AI Chatbots

Gone are the days of long wait times and frustrating call transfers. AI chatbots, fueled by natural language processing (NLP), can act as digital assistants that provide instant responses, resolve queries, and even offer personalized financial advice, 24/7.

For instance, chatbots can assist customers with tasks such as:

- Account balances and transaction history

- Making payments or transfers

- Providing information on financial products and services

- Tracking spending and creating budgets

- Financial goal setting and monitoring

- Debt management

- Personalized financial advice

- Preparing to buy a home

- Answering FAQs

Implementing AI chatbots enhances customer satisfaction and frees up human agents to focus on complex cases that need personalized attention. Plus, chatbots learn from every interaction and become more accurate over time.

Streamlining Operations and Reducing Risk with AI

AI services excel in handling repetitive, data-intensive tasks. This allows employees to focus on tasks that need creativity, strategic thinking, and human judgment.

For example, AI is being used in areas such as:

- Fraud detection

- Risk assessment

- Regulatory compliance

These AI algorithms can analyze enormous amounts of data in real-time. This capability allows them to flag potential threats, manage regulatory obligations, and reduce operational costs associated with manual processes. Using AI in this way helps manage risk. It also minimizes human error and strengthens a financial company’s overall security posture.

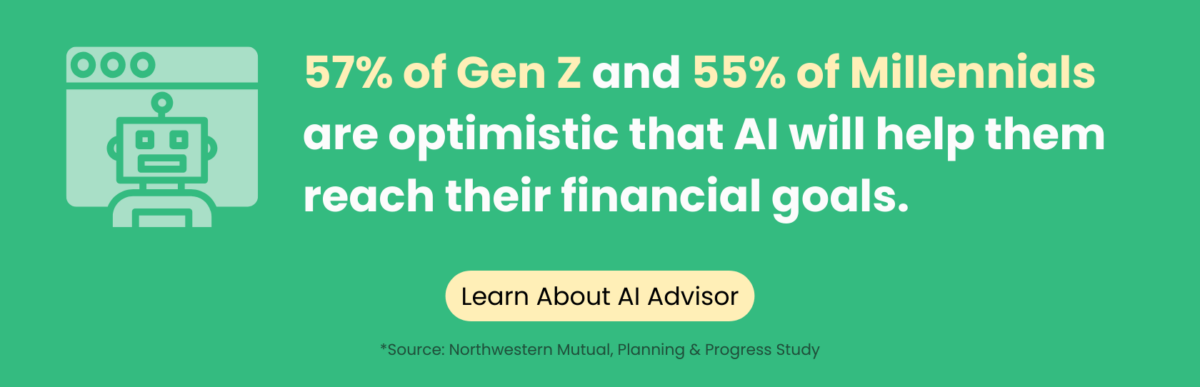

The Emergence of AI Financial Advisors

One of the most transformative impacts of AI services in finance is the emergence of AI financial advisors. Often referred to as robo-advisors, they offer algorithm-driven, personalized financial advice to a wider customer base. AI financial advisors are typically a fraction of the cost of traditional human advisors. They assess the client’s financial situation and goals. This information allows them to offer tailored debt management advice, homebuyer readiness education, and other automated financial planning assistance. This makes financial guidance accessible to more people, especially those intimidated by or priced out of working with traditional advisors.

Important Considerations

While AI services offer significant advantages, financial institutions should carefully consider the ethical and practical implications. For example, they must ensure fairness and transparency. Institutions should work towards ethical AI within algorithms and maintain responsible use.

Conclusion

The adoption of AI services across industries is more than just a trend. For financial companies, the potential of AI is limitless. By embracing AI, we are witnessing an exciting era of automation, efficiency, and data-driven decisions.

As AI technologies advance, we expect even more innovative use cases in finance. Financial companies must prioritize customer privacy, security, and responsible ethical practices. By using this technology responsibly and strategically, financial institutions can adapt, innovate, and successfully navigate the digital future.

FAQs About AI Services

What is the purpose of AI services?

AI services refer to ready-made software solutions that can be customized using your enterprise data. This is different than machine learning tools for those who do not have in-house data science expertise. Some of the main types of AI solutions available now focus on customer service, automating work, improving security, marketing, and more. These solutions can help businesses build intelligent applications.

What is AI service learning?

Service learning refers to hands-on learning programs. Many people worry that the advancement of AI services will replace their jobs. Instead, people should prepare by exploring programs that allow them to expand their own skills. They can then use those skills to address community needs.