Prepare for Generative AI: A 5-Step Guide for Your Business

Don’t let the AI revolution catch you off guard. Learn how to prepare for generative AI in your business with these 5 essential steps, from education to ethical considerations.

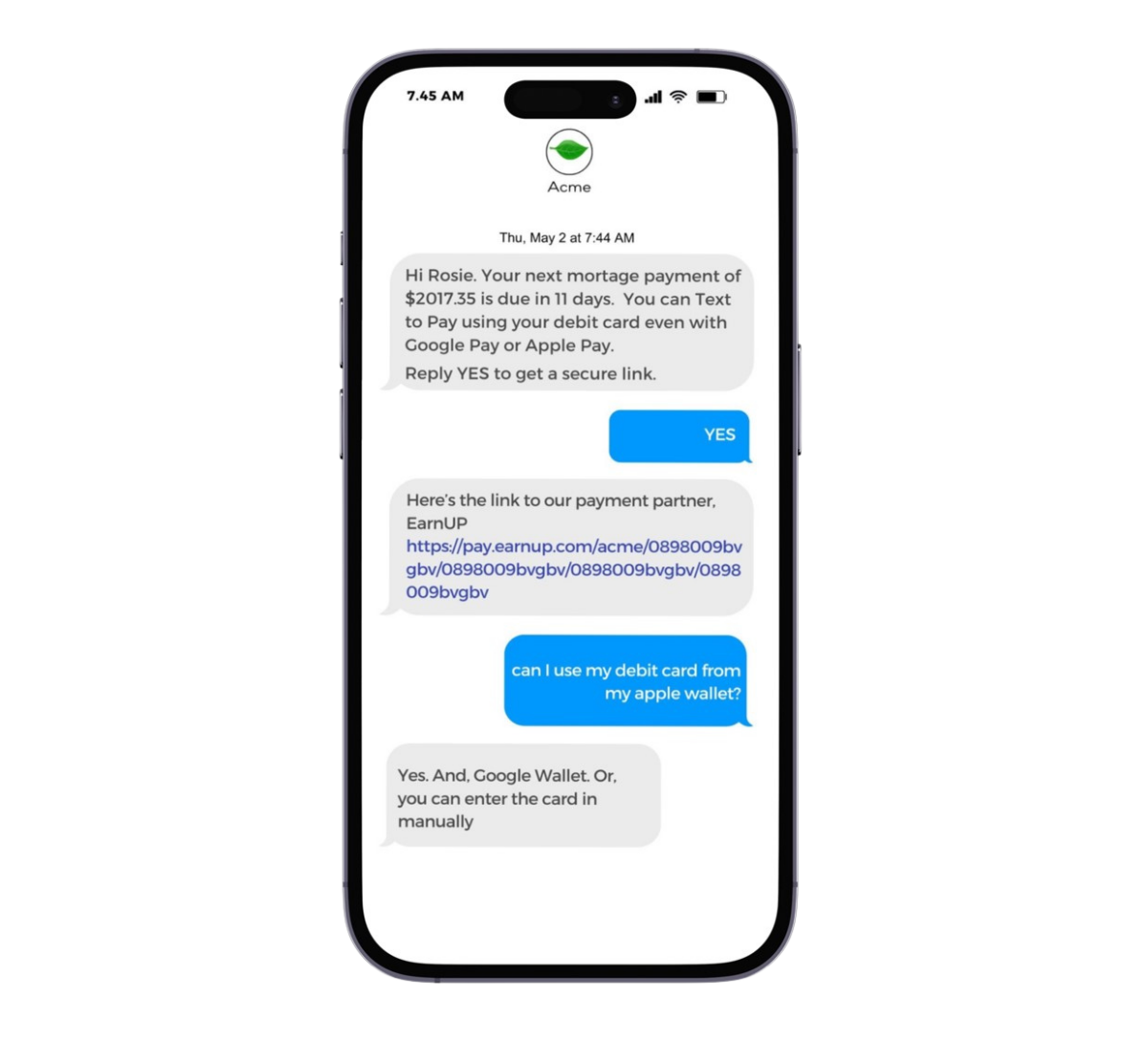

Streamline payment processes, improve customer satisfaction, and increase revenue through more timely payments.

With a staggering 98% open rate, texting has surpassed phone calls and emails as the preferred customer support channel.

By implementing Text to Pay services, mortgage servicers, including default and specialty servicers, can streamline their payment processes, improve borrower satisfaction, and potentially increase their revenue through more timely payments.

This technology aligns with the growing trend of mobile-centric financial management, making it a valuable addition to a servicer’s payment options.

Reduce Customer Service Calls

By providing a self-service payment option and real-time payment processing, Text to Pay can significantly reduce call center volume.

Automate Processes

Text to Pay automates payment reminders and collection, which streamlines operations for mortgage servicers.

Promote Recurring Payments

Leverage Text to Pay as a campaign to increase recurring autopay via ACH.

Expand Payment Options

The service allows borrowers to choose from various payment methods such as Apple Wallet, Google Pay, ACH, or debit cards.

Reduce Delinquencies

Text to Pay can help decrease delinquencies by up to 50% through advanced notifications and reminders.

This ensures borrowers are promptly alerted about upcoming payments, reducing the likelihood of missed or late payments.

Faster Receivables

By simplifying the bill payment process, Text to Pay speeds up receivables and improves cash flow for mortgage servicers.

Convenience

>80% of Americans text regularly, making Text to Pay a familiar and convenient option for borrowers

Promote eBilling Adoption

Offering Text to Pay can encourage borrowers to adopt other digital services, such as customer service chat and paperless statements.

Works seamlessly with existing mortgage servicing platforms and customer portals.

Appeals to a more broad demographic and satisfies expectation on access to service

Self-service payment links reducing the need to take card details over the phone.

Extends offerings to include professional services and democratizes access to financial expertise

One click sends borrowers to a secure payments page eliminating the need to rememer account number or reset password.

Borrowers can access consistent information whether they're using the text service or online portal.

Don’t let the AI revolution catch you off guard. Learn how to prepare for generative AI in your business with these 5 essential steps, from education to ethical considerations.

The Financial Stability Automation Platform is not a substitute for financial advice from a professional who is aware of facts and circumstances for a specific situation, and EarnUp Inc. is not providing any financial advice through the Financial Stability Automation Platform. The Financial Stability Automation platform should not be used to make any credit, lending, or other financial decisions.

AI Advisor is not a substitute for financial advice from a professional who is aware of facts and circumstances for a specific situation, and EarnUp Inc. is not providing any financial advice through AI Advisor. AI Advisor should not be used to make any credit, lending, or other financial decisions.

EarnUp Inc.

2370 Market St Ste 203

San Francisco, CA 94114-1521 USA

800-209-9700

© EarnUp 2025 All Rights Reserved