As more consumers rely on mobile devices as their primary means of communication and commerce, businesses must adapt their payment strategies. This means embracing solutions like pay by text that offer a more streamlined, user-friendly approach for both businesses and customers. But what exactly is pay by text and why should lenders consider integrating this payment solution into their operations?

What Is Pay by Text?

Pay by text, sometimes referred to as SMS payments or text to pay, leverages the power of text messaging for secure payment collection. Instead of mailing paper invoices or relying on email, which may get lost in an overflowing inbox, lenders and servicers use this method to send payment reminders and links directly to a borrower’s cell phone.

Borrowers then click a secure payment link, pre-populated with payment details, eliminating the hassle of logging into various portals or remembering login credentials. It’s all about convenience. In today’s fast-paced world, simplifying the borrower journey is paramount to building borrower satisfaction and keeping the borrower engaged with your brand.

The Power of Text Messaging for Businesses

Today’s borrowers are practically joined at the hip with their smartphones. In fact, they spend about 23 hours a week interacting via text. And with 99% of text messages read – and 95% of those opened within the first three minutes – businesses simply cannot ignore their potential.

For industries like mortgage lending, text messaging offers a reliable communication channel for sending time-sensitive information and urgent notices. Plus, when it comes to receiving those all-important mortgage payments and reducing late payments, well, nothing quite beats a gentle nudge or timely reminder directly to a customer’s phone through a text payment.

Understanding the Process: How Pay by Text Works

The pay-by-text process is fairly straightforward and breaks down into these steps:

1. Payment Initiation: Sending the Text

The lender sends a text message to the customer’s mobile phone. This message will typically include a brief description of the payment due, the amount owed, and a unique payment link.

For the mortgage industry, that might look like, “Hi [customer name], this is a friendly reminder that your monthly mortgage payment of $[amount] is due on [date]. Please submit your payment securely using this link: [Payment Link]. Thank you.”

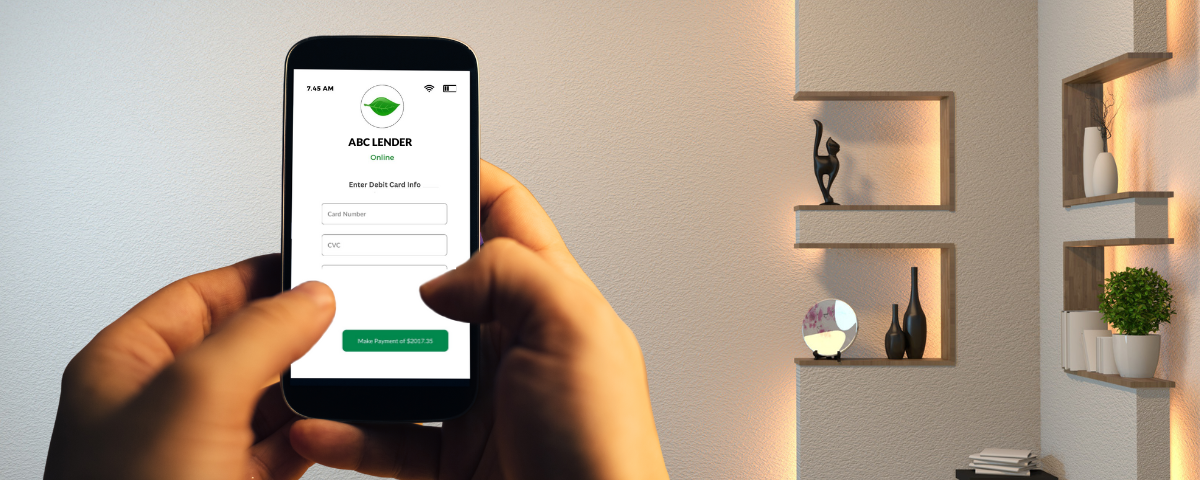

2. Customer Payment

Upon receiving the text, customers simply click the secure payment link. Since this link often leads them to a pre-populated payment gateway, they won’t need to input a lot of details. They might be presented with payment options like paying directly from their bank account, debit card, credit card or even digital wallets such as Apple Pay, depending on the provider. Borrowers simply select their desired method and confirm.

3. Confirmation

Once the payment is successfully processed, both the lender and the borrower receive a confirmation message. This text confirming receipt of payment details, including the amount paid and date of payment.

Key Benefits of Adopting Pay by Text for Mortgage Lenders

Let’s take a look at why pay by text is such a powerful tool for mortgage lenders.

1. Meeting Customers Where They Are

According to Statista, mobile devices account for over half of all website traffic worldwide. Mobile phones are central to how consumers communicate, access information and manage their finances. In this increasingly mobile-first environment, it makes sense to adopt processes, such as pay by text that seamlessly integrate into existing consumer behavior.

2. Streamlined Payment Experience

With a pay by text option, there’s no need for customers to log into online portals, search for account information or input lengthy credit card details. This streamlined payment process takes a matter of seconds from start to finish and makes the overall payment experience far less time-consuming.

For mortgage lenders juggling large client portfolios, pay-by-text helps to accelerate a traditionally slow collections process and improve transaction speed.

3. Improved Payment Rates

Because messages are instant, difficult to miss, and arrive on a device consumers are rarely without, payment reminders have a high success rate. This will make it easier for your borrowers to settle bills and you can reduce late payments. With higher engagement rates come reduced delinquency rates, improving your business’ cash flow, which is always welcome news in the lending space.

4. Cost Effective for Businesses

Pay by text eliminates many costs associated with traditional methods, such as printing, postage, and manual processing. Plus, if you’re struggling with a backlog of accounts receivables or frequently have customers paying late, well, let’s just say pay by text just might save your collections team from countless hours chasing down outstanding payments.

5. Enhanced Security and Reduced Compliance Burden

A legitimate and trustworthy text to pay system comes equipped with security protocols. This often includes features such as end-to-end encryption, tokenization, and two-factor authentication that work to safeguard sensitive data. That also helps mortgage lenders struggling to maintain compliance.

Use Cases for Pay by Text for Lenders and Servicers

Pay by Text offers a range of benefits for lenders and servicers, providing a convenient and modern experience for borrowers. Here are some key use cases:

Servicers

- Convenient Experience: Offer borrowers a seamless and convenient way to make payments, reducing the likelihood of delinquency and improving the overall borrower experience.

- Modern Borrowers: Meet the evolving expectations of modern borrowers, who increasingly prefer digital channels for managing their finances.

- Retention at Refi: Keep borrowers engaged with your brand when they refinance, reducing the risk of losing them to competitors.

Lenders

- Brand Visibility: Keep your brand top of mind with borrowers, even after closing, by offering a modern and convenient payment option.

- Ongoing Communication: Maintain open lines of communication with borrowers, improving the likelihood of cross-selling and upselling opportunities.

- Improved Interim Servicing: Encourage borrowers to sign up for pay by text after closing, streamlining the payment process and reducing delinquency risks.

Conclusion

In today’s tech-savvy world, pay by text is revolutionizing the way businesses interact with customers. By meeting consumers on a platform already deeply integrated into their daily routines, you have a higher probability of not only connecting, but engaging. This not only leads to a better customer experience, but helps create more sustainable business practices for all parties.

So, yes, incorporating pay by text, especially within an industry like mortgage lending that often feels clunky or antiquated, could breathe new life into your collections processes and elevate your business.

Pay By Text FAQs

How do you pay by text?

Paying by text is straightforward. When you receive a text invoice or payment request from a company offering this service, you’ll typically see a link. Simply click on the link, which will then direct you to a secure online payment page where you can complete the transaction.

Is pay by text safe?

A major concern surrounding any online payment method is, understandably, security. However, when properly implemented, pay by text uses various encryption and security measures. For example, top platforms will utilize tokenization to replace sensitive payment details with unique, randomized codes.

It’s important, however, that both businesses and consumers choose reputable platforms, exercise vigilance and always verify the legitimacy of the requester.

Can I send money by text?

Sending money and paying for goods and services via text message are two different things. Currently, there aren’t many established, reputable, or safe platforms widely used for person-to-person money transfers strictly via text message. Peer-to-peer (P2P) apps are widely considered to be the faster, safer route to take.