EarnUp’s award-winning Enterprise Platform mitigates risk, uncovers opportunities to improve portfolio health, and offers opportunities to recapture business.

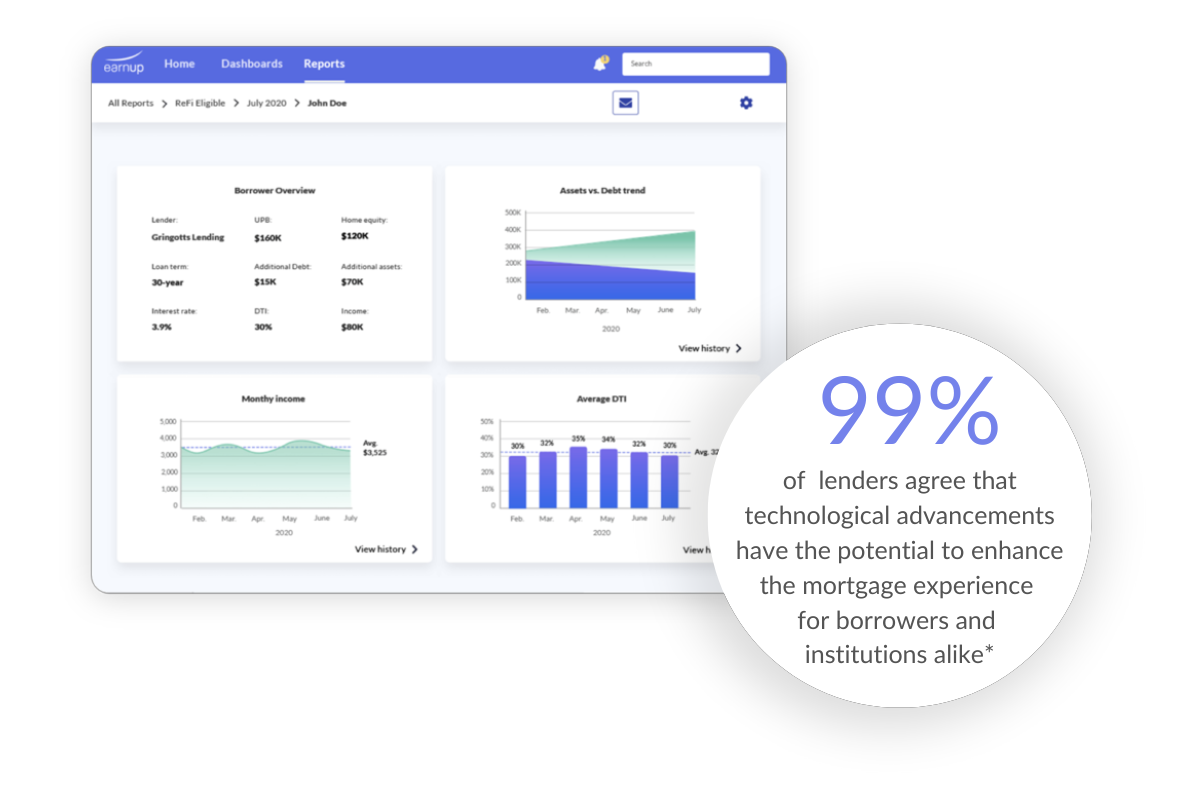

EarnUp X.ai provides unique borrower insights that support proactive risk mitigation, borrower performance, and improve portfolio performance.

For Lenders, EarnUp X.ai enables borrower-level data & analytics once limited to Servicers.

Prioritize borrowers for proactive and targeted outreach to save on costly recapture churn and create a repeatable strategy for borrower retention.

Detailed borrower dashboards reveal DTI ratios, performing vs. delinquent loans, asset-to-debt trends, and more, signaling when your borrower may be ready to refinance, purchase, or pay-off a loan.

Decrease the workload for your in-house customer support by reducing friction and improving accuracy in the post-close borrower payment process.

Improve borrower loyalty by making personalized recommendations based on real-time updates about your borrower's financial health.

Early intervention and custom alerts make it easy to spot the red flags in your borrower's financial picture.

Whether you're servicing the loan or not, always know what happens with borrowers after the loan closes.

EarnUp Xperience, a white-label platform, digitizes the payment process and provides borrowers a consistent, seamless experience, particularly during servicing transfers.

This has reduced missed payments by up to 20%.

Ensure a smooth and consistent experience and seamless transition throughout the life of the loan, even when the loan transfers to a new servicer.

Reduce the risk of missed or late payments by simplifying the loan repayment process. Xperience users see up to an average debit success rate of 99.6%!

Personalized communication reminders and informs borrowers about upcoming payments, changes in loan status, and updates, keeping them engaged with you and their loans.

Build loyalty and foster trust with the help of a branded user interface and customizable budgeting tool. Most lenders see up to a 200% borrower recapture rate improvement!

Automate auto, personal, student, and mortgage loan debit payments all from one user-friendly platform while allowing borrowers to leverage flexible payment schedules.

*Borrower retention, cost savings, and other data are based on active anonymized customers, which is a small sample size, and representative of “Top 20 Originator.”

Lenders utilizing EarnUp XLerate can cut their interim servicing costs by up to 70 percent* by automating post-close borrower payments, streamlining loan transfers, and delivering seamless communication.

Collecting interim loan payments can cost over $120 per loan.* Say goodbye to checks and costly manual payment reconciliation.

No matter where the loan goes, you’ll always get paid with payment routing from lender to servicer during the loan transfer process.

Expedite payment reconciliation and settlement between lenders and servicers, eliminating costly and time-consuming processes.

Reduce borrower confusion by keeping your borrower up to date with automated emails and communication that complement RESPA communications.

EarnUp Inc.

2370 Market St Ste 203

San Francisco, CA 94114-1521 USA

800-209-9700

© EarnUp 2025 All Rights Reserved