Can AI give financial advice? The rise of AI has undoubtedly captured the public’s imagination, and personal finance is no exception. While skepticism persists, the reality is that AI presents a unique opportunity for your business.

The financial sector has already seen significant benefits from AI. Fraud detection tools and investment analysis platforms powered by AI are demonstrably effective. However, personal finance poses a distinct challenge. Individual financial goals and risk tolerances vary greatly, making a “one-size-fits-all” solution impractical.

Can AI Give Financial Advice?

AI is undoubtedly making waves in the financial world, and a critical question lingers: can AI truly offer financial advice? The answer, like most things in finance, is nuanced.

Yes, AI Can Be Your Client’s Financial Co-Pilot:

AI excels at processing massive amounts of data at lightning speed. This superpower allows AI to identify patterns and trends within financial data (or anonymized market data) that might escape even the most seasoned human advisor.

From Insights to Actionable Tips:

These AI-powered insights translate into actionable tips tailored to your client’s unique financial situation. Whether they’re planning for retirement or seeking to optimize cash flow, AI can provide personalized recommendations for:

- Investment Strategies: AI can analyze risk tolerance and financial goals to suggest suitable investment options, helping build a diversified portfolio aligned with your client’s needs.

- Debt Management: AI can identify areas to optimize debt repayment strategy, potentially saving money on interest charges and accelerating their debt-free journey.

- Budgeting and Savings: AI can analyze spending habits and suggest areas for potential savings. It can even automate transfers to savings accounts and help reach financial goals faster.

- Fraud Detection: AI can continuously monitor financial activity for suspicious patterns, providing an extra layer of security against fraud attempts.

The Power of Partnership: Human Expertise Meets AI Insights

While AI offers valuable insights, it’s important to remember it’s still a tool. Financial decisions often involve complex considerations and emotional factors best navigated with the guidance of a human advisor. The ideal scenario? AI augments the expertise of a human advisor, providing them with data-driven insights to personalize financial plans and offer more informed recommendations to their clients.

The Future of AI Financial Advice

The future of AI in financial advice is bright. As AI technology continues to evolve, we can expect even more sophisticated tools that can not only analyze data but also understand and respond to your financial goals and risk tolerance in a more nuanced way. However, the human touch will likely remain a critical element in financial planning, ensuring that AI complements, rather than replaces, the expertise of human advisors.

The Pros and Cons of AI Financial Advice

The advantage of AI-driven financial guidance lies in its accessibility and affordability compared to human advisors. With the ability to quickly sift through vast amounts of data, AI offers personalized suggestions that fit individual needs and aspirations. This is particularly beneficial for individuals who may not have had access to financial guidance before, or those who are just starting to plan futures.

In addition, financial guidance can offer 24/7 support, allowing individuals to receive guidance at any time and from any location. This convenience factor is particularly appealing to those with busy schedules or prefer to manage their finances at their own pace.

However, there are potential drawbacks to relying solely on AI for financial advice. While AI can analyze data and identify trends, it lacks the human touch and emotional intelligence that a skilled financial advisor can provide. AI may not be able to fully understand the nuances of an individual’s personal values, risk tolerance, and long-term aspirations.

For example, AI may struggle to emotional implications of a particular financial decision, or the subtleties of an individual’s personal goals. A human advisor, on the other hand, can provide a more comprehensive approach to financial planning, taking into account an individual’s entire financial situation and personal circumstances.

Furthermore, while AI can analyze data and provide guidance based on that data, it may not be able to adapt to unexpected changes in an individual’s income, expenses, or other factors. A human advisor, on the other hand, can quickly make these changes and provide guidance that takes into account the new circumstances.

How AI is Reshaping the Financial Planning Landscape

While some limitations exist, the influence of AI on financial planning is undeniable. Tools like robo-advisors and advanced analytics are fundamentally changing the game, paving the way for quicker, more intelligent financial management decisions.

The Rise of the Robo-Revolution: Robo-advisors, powered by AI algorithms, have democratized investment management. No longer is personalized financial guidance reserved for the ultra-wealthy. Robo-advisors analyze your client’s financial goals, risk tolerance, and market conditions to build and manage an investment portfolio tailored to you. This not only makes investing more accessible but also reduces costs compared to traditional financial advisors.

The Power of Predictive Analytics: AI’s impact goes beyond automation. Advanced analytics empower advisors (and individuals with DIY investing preferences) to make smarter decisions. These tools analyze vast amounts of financial data, including market trends, historical performance, and economic indicators. This comprehensive analysis provides a deeper understanding of your client’s financial situation and allows for more accurate predictions about potential future outcomes.

AI’s Economic Powerhouse Potential: The financial impact of AI in financial services is significant. AI has the ability to:

- Automate Repetitive Tasks: Freeing up valuable advisor time for more strategic endeavors and client interaction. This will also allow your clients to automate savings and their repetitive tasks.

- Optimize Investment & Saving Strategies: AI can identify patterns and trends that humans might miss, leading to potentially higher returns.

- Enhance Risk Management: AI can continuously monitor financial activity and identify potential risks like fraud or missed payments.

It’s important to remember that AI is a powerful tool, but it’s not a replacement for human expertise. Complex financial situations or the need for emotional support still require a human advisor’s experience and judgment. However, with AI handling the heavy lifting of data analysis and automation, advisors can become more efficient and effective, ultimately providing a superior service to their clients.

AI vs. Human Financial Advisors: A Comparison

Ever wondered if AI can match up with a real-life financial advisor? Here’s a closer look at what sets these two methods of getting financial advice apart.

Personalized Service vs. Automated Recommendations

One of the big perks of working with a human financial advisor is the personal touch they bring. They take time to get to know the specific money situations, goals, and how much risk a consumer is comfortable with. This way, their advice fits exactly what a client needs.

On the other hand, AI-powered financial advice often feels more automated and uniform. Although these algorithms can crunch the numbers and spit out suggestions, they might miss some of the finer details that make a situation unique.

The Value of Human Expertise and Emotional Intelligence

A significant gap exists between AI systems and human financial advisors due mainly to expertise levels coupled with the emotional intelligence skills humans possess. Experienced financial professionals draw from extensive market know-how along with effective strategies around investing plus solid risk handling practices—helping deliver important guidance needed by individuals seeking sound advice on finances today.

Human advisors excel because they possess emotional intelligence that lets them relate deeply to what an individual is going through financially. They reassure you during challenging times while keeping an eye on long-term aims. Plus, having someone experienced listen and advise makes tackling significant money matters less overwhelming.

How Consumers are Using AI for Financial Advice

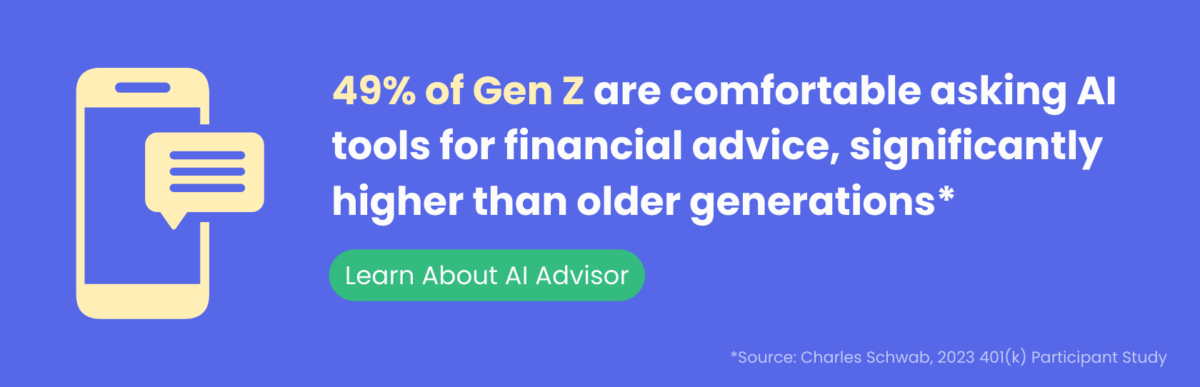

The advent of AI has revolutionized various industries, and the financial sector is no exception. For consumers seeking personalized and efficient financial advice, AI offers numerous advantages.

Personalized Budgeting Assistance

One way consumers leverage AI is through personalized budgeting assistance. Various applications utilize machine learning algorithms to analyze spending habits and suggest tailored budgeting plans. This helps users manage their finances more effectively by providing real-time insights into their spending patterns.

Simplified Mortgage Processes

Mortgage lenders and servicers benefit from AI-driven tools that simplify complex mortgage processes. By utilizing predictive analytics, these tools can offer potential homeowners customized loan options based on their credit history and income levels. For example, a consumer can receive instant recommendations on suitable mortgage products from platforms integrated with advanced algorithms.

Improved Credit Score Management

- Error Detection: Many consumers use AI-powered applications to detect errors in their credit reports promptly.

- Credit Building Strategies: These apps also provide actionable strategies for improving credit scores over time, which can be particularly beneficial when applying for mortgages or other loans.

Easier Investment Decisions

Apart from lending solutions, many individuals turn to robo-advisors powered by artificial intelligence for investment decisions. These digital advisors evaluate market trends using big data analytics to offer well-informed investment recommendations tailored to individual risk tolerance levels.

This technological advancement allows even novice investors access to sophisticated financial planning resources traditionally reserved for wealthier clients who work with human advisors.

The Future of AI in the Financial Services Industry

Although AI isn’t quite prepared to fully replace human financial advisors at this point, it’s on track to revolutionize the industry. With continuous technological advancements, you can expect AI’s role in money management to grow significantly.

Potential Applications of Generative AI

Financial planning is undergoing a significant transformation fueled by generative AI, a powerful technology capable of creating personalized content based on vast amounts of data. This opens exciting possibilities for enhancing the way we approach financial wellness, particularly in these key areas:

Homebuyer Readiness:

- Personalized Roadmaps: Generative AI can create customized guides for first-time homebuyers. These guides could outline steps towards achieving homeownership, including budgeting for a down payment, managing credit scores, and understanding mortgage options. Interactive simulations could demonstrate the impact of different saving strategies on their ability to buy a home.

- Second Chance Support: For those previously denied a loan, generative AI can offer tailored advice to improve their financial standing. AI-powered tools can analyze their credit reports, pinpoint areas for improvement, and suggest personalized action plans to increase their chances of loan approval.

Strategic Debt Guidance:

- Debt Payoff Plans: Generative AI can create dynamic debt repayment strategies. These plans would consider factors like interest rates, minimum payments, and income to prioritize debt repayment and track progress towards a debt-free future.

- Debt Consolidation Analysis: AI can analyze the feasibility and potential benefits of debt consolidation for each individual’s unique financial situation. Clients could receive clear explanations and visual representations of the potential impact of consolidation on their overall debt burden.

Financial Health Monitoring:

- Automated Tracking & Reporting: Generative AI can automatically analyze financial activity and generate personalized reports highlighting spending trends, budgeting adherence, and potential areas for improvement. These reports could be presented in clear, concise language with visualizations to facilitate easy understanding.

- Risk Identification & Proactive Alerts: AI can monitor financial health and identify potential risks in real-time. Clients could receive alerts for upcoming bills, unusual spending patterns, or potential fraudulent activity, empowering them to make informed financial decisions.

Budgeting, Management & Tracking:

- AI-powered Budget Assistants: Imagine your clients receiving personalized budgeting recommendations based on their income, expenses, and financial goals. Generative AI can create virtual budgeting assistants that offer real-time feedback on spending habits and identify opportunities for savings.

- Interactive Goal Setting & Tracking: Generative AI can craft dynamic tools for setting and tracking financial goals. Interactive dashboards could provide visual representations of progress towards savings goals, allowing users to adjust their strategies as needed.

Expense Analysis & Financial Guidance:

- Personalized Spending Insights: AI can analyze spending patterns and generate reports highlighting areas where adjustments can be made. This personalized approach to expense management empowers individuals to make informed spending decisions to reach their financial goals faster.

- Tailored Financial Advice: Based on individual financial situations and goals, generative AI can offer personalized guidance on various financial products and services. This readily available, tailored advice fosters informed decision-making when navigating complex financial choices.

Improved Financial Literacy:

- Interactive Learning Modules: Generative AI can create engaging and interactive financial literacy modules tailored to individuals’ specific needs and financial goals. These modules could utilize gamification elements and personalized scenarios to make learning about finance engaging and effective.

- Explainable AI: When AI offers financial advice, generative AI can explain the rationale behind its recommendations. This transparency fosters trust and empowers individuals to make informed decisions rather than blindly following AI suggestions.

By leveraging generative AI, financial planning can become a more personalized, interactive, and accessible experience for everyone. This technology holds immense potential to empower individuals to achieve their financial goals and navigate the complexities of personal finance with greater confidence.

Collaboration Between AI and Human Advisors

While AI continues to advance, it’s still a long way from completely taking over the role of human advisors. We’ll likely see a mix where both humans and machines collaborate in providing financial advice. Picture an AI-powered research tool, quickly pulling up insights and recommendations for advisors to share.

When AI teams up with human advisors, they create a service experience that’s hard to beat alone. It’s an intriguing development for businesses and customers alike.

Regulatory Developments

With AI making its way into financial services, we’re bound to hit a few bumps. Regulators will face challenges as they figure out how best to manage and oversee the use of AI in giving financial advice and planning.

Tackling significant issues such as data privacy, algorithmic fairness, and customer safety is crucial in today’s world. Ensuring that all users receive fair treatment from AI systems, without widening existing disparities, is a challenging yet essential task. It is equally important to highlight where these advanced tools may fall short or pose risks, especially in financial contexts like online brokerage services and digital assistants.

Tackling these complex issues requires collaboration between policymakers, industry heads, consumer representatives, and tech experts. However; nailing it would mean a huge win—a financial services sector that’s smarter in operation while being customized and reachable like never before.

It’s safe to say that AI is definitely worth keeping an eye on.

Key Takeaway:

AI can crunch numbers but struggles with personal nuances. Human advisors offer personalized plans and reassurance AI can’t match.

Finding a good advisor means knowing goals, risk tolerance, and checking qualifications like CFP or CFA.

The future might see AI assisting human advisors for more efficient, personalized financial advice while navigating regulatory challenges together.

FAQs in Relation to Can AI Give Financial Advice

Is there an AI financial advisor?

Yes, several AI tools like robo-advisors provide automated investment advice using algorithms and data analysis.

Can AI write a financial plan?

AI can draft personalized financial plans by analyzing an individual’s income, expenses, goals, and risk tolerance.

How does AI affect financial advice?

AI offers faster data analysis and trend spotting. It makes tailored recommendations but lacks emotional insight.

Can ChatGPT give financial advice?

No, ChatGPT provides general information. For specific advice on personal finance or investments consult a human expert or personal finance AI tools.

Conclusion

So, can AI give financial advice? The answer is yes… and no. While AI can certainly help us make more informed decisions about our money, it’s not a complete replacement for human expertise and personalized guidance. AI might be able to crunch the numbers and identify trends, but it can’t understand the emotional and psychological factors that influence financial choices.

Managing money wisely means learning all you can, asking for advice from people you trust, and using AI tools to help make better decisions. With the right mix of human insight and machine smarts, we’ll be well on our way to a more secure financial future.