The mortgage industry is no stranger to innovation. From the rise of online lenders to the adoption of digital documentation, the way we buy and sell homes has drastically changed. Now, with the emergence of mortgage AI chatbot technology, the industry stands on the brink of another significant shift. But are mortgage AI chatbots just a passing fad, or are they here to stay? And more importantly, how can they benefit lenders and borrowers in this fast-paced digital age? Let’s explore this new frontier in mortgage lending and uncover the potential it holds for all parties involved.

Understanding the Rise of the Mortgage AI Chatbot

The global chatbot market has skyrocketed in recent years. NextMSC reports that the market was valued at $602.9 million in 2019. This figure is projected to reach an impressive $10.29 billion by 2030. This growth speaks volumes about the increasing acceptance and demand for AI-powered solutions across industries.

The mortgage sector is no exception. Lenders are increasingly turning to AI chatbots to improve customer service and automate tasks. The appeal is clear – mortgage AI chatbots can streamline processes, enhance customer experience, and offer 24/7 support. They can also help mortgage companies generate leads, qualify leads, and provide customers with personalized product offers.

Transforming the Mortgage Lending Landscape

Mortgage AI chatbots aren’t just answering basic customer questions or providing mortgage balances; they’re capable of so much more. They’re becoming more sophisticated and capable of handling various aspects of the lending process, freeing up human agents to focus on complex issues. Let’s explore how they are transforming mortgage lending.

Streamlined Application Processes

Anyone who’s applied for a mortgage knows it involves a lot of paperwork and can be very time-consuming. Mortgage AI chatbots can guide applicants through the loan application process. Imagine a mortgage AI chatbot that helps gather necessary information, verify documents, and even answer questions about specific loan programs.

They can even pre-qualify potential clients and collect their email addresses. This not only simplifies things for the applicant, it saves lenders valuable time and resources, allowing them to focus on providing excellent customer support to existing clients.

Personalized Mortgage Advice

Different borrowers have different financial situations and goals. Mortgage AI chatbots can be programmed to offer personalized advice on suitable mortgage products, interest rates, and repayment options. Acting as intelligent mortgage calculators, they empower customers to make informed decisions. They analyze financial data, run simulations, and present personalized recommendations based on individual needs, taking the guesswork out of choosing the right mortgage.

Enhanced Customer Support

We live in a 24/7 world, and customers expect instant answers to their questions. Mortgage AI chatbots deliver exactly that, offering 24/7 support to address inquiries, provide updates, and troubleshoot issues — even outside of traditional business hours.

This means customers don’t have to wait for a human representative to be available. This level of responsiveness leads to increased client satisfaction and a smoother lending experience. AI chatbots can also help mortgage lenders improve their lead-generation efforts.

Reduced Operational Costs

For lenders, efficiency translates into lower costs. This is where mortgage AI chatbots truly shine. By automating tasks, they help businesses optimize workforce allocation. This means human agents can dedicate more time to tasks that require a human touch, while routine queries are handled by the AI-powered assistant.

They can also help to reduce the risk of errors and improve compliance with regulations. For instance, Tata reduced its call center queries by almost 70% with their AI chatbot.

Helping Borrowers Get Mortgage Ready

To ensure borrowers are well-prepared for the mortgage application process, mortgage AI chatbots can offer the following support:

- Improve Credit Score: Mortgage AI chatbots can provide personalized credit score improvement plans, offering actionable tips and recommendations to help borrowers increase their credit score and become more attractive to lenders.

- Financial Planning: Mortgage AI chatbots can offer personalized financial planning advice, helping borrowers create a budget, reduce debt, and improve their overall financial health.

- Saving for a Down Payment: Mortgage AI chatbots can provide guidance on saving for a down payment, offering tips on how to create a savings plan, set realistic goals, and explore down payment assistance programs.

- Decreasing Debt: AI chatbots can help borrowers develop a plan to decrease debt, providing advice on debt consolidation, credit card debt reduction, and other strategies to improve their debt-to-income ratio.

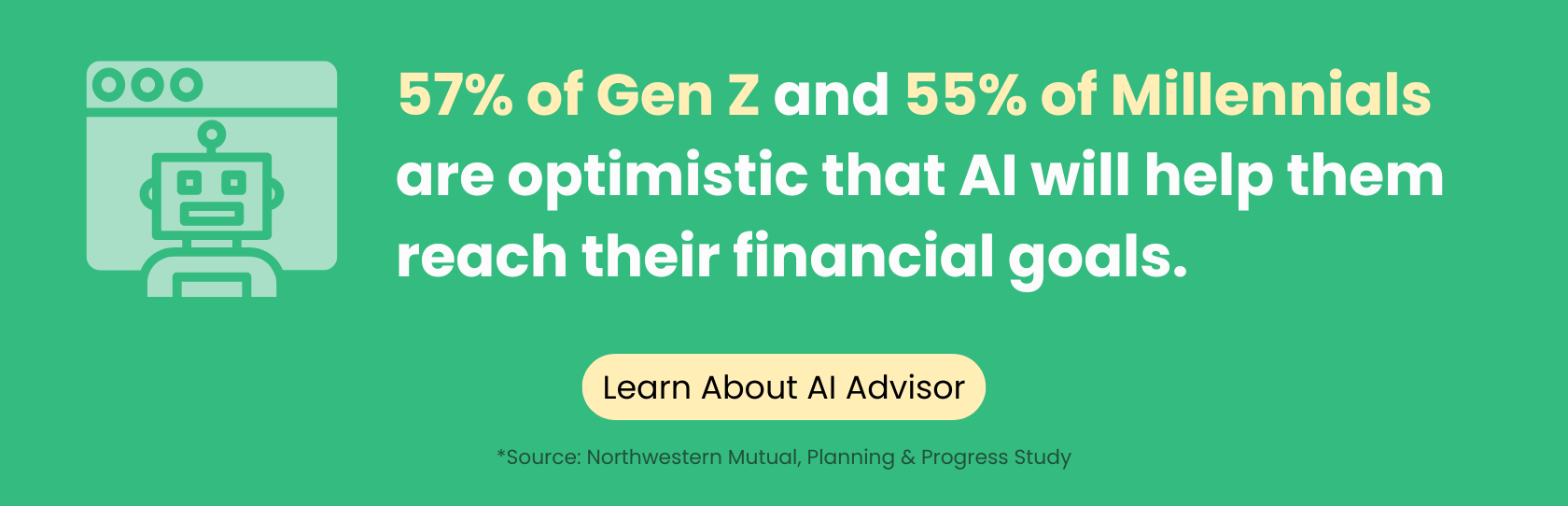

Attracting a Younger Demographic

To appeal to a younger demographic, mortgage AI chatbots can focus on the following strategies:

- Digital Engagement: Mortgage AI chatbots can engage with younger borrowers through digital channels, such as social media, messaging apps, and online portals, providing them with a convenient and familiar way to interact with lenders.

- Personalized Content: AI chatbots can offer personalized content and resources, tailored to the needs and preferences of younger borrowers, helping them navigate the mortgage process and make informed decisions.

- Educational Resources: AI chatbots can provide educational resources, such as videos, infographics, and blog posts, to help younger borrowers understand the mortgage process.

- Interactive tools: AI chatbots can provide interactive tools, such as mortgage calculators and quizzes, to help younger borrowers engage with the mortgage process.

- Real-time updates: AI chatbots can provide real-time updates on the mortgage application process, keeping younger borrowers informed and up-to-date.

FAQs about Mortgage AI Chatbots

What information do I need to provide to a mortgage AI chatbot?

When interacting with a mortgage AI chatbot, you’ll typically need to provide information similar to what you’d give a human loan officer. This includes your income, employment history, credit score range, desired loan amount, and the type of property you’re considering. You should also expect to provide your Social Security number, which is used to verify your identity and pull your credit report.

Are mortgage AI chatbots secure?

Reputable mortgage AI chatbots prioritize security and utilize encryption to protect your information. They should also have a privacy policy in place that outlines how they collect, use, and share your data. Just like with any digital service, make sure you’re using a trusted platform and check for security badges or certifications on their website.

Can a mortgage AI chatbot actually replace a human loan officer?

While mortgage AI chatbots offer significant support and convenience, they might not entirely replace human loan officers just yet. Many people appreciate the opportunity to discuss their individual circumstances, ask complex questions, and build a relationship with a dedicated professional.

Mortgage AI chatbots can free up loan officers to spend more time on complex tasks, such as providing financial advice and negotiating rates. Ultimately, AI chatbots and loan officers can work together to provide a better experience for borrowers.

What does the future hold for mortgage AI chatbot technology?

AI is a rapidly advancing field. As the technology matures, we can expect even more sophisticated mortgage AI chatbots capable of handling a wider range of tasks. Imagine AI negotiating rates on your behalf, flagging potential issues before they arise, or offering customized financial advice beyond just mortgages. The possibilities are exciting.

It is expected that more and more financial institutions will adopt the use of conversational AI in the coming years to provide customers with 24/7 service, personalized experiences, and to automate tasks. This will free up human representatives to focus on more complex issues.

Conclusion

Mortgage AI chatbots represent a major evolution in the lending process. Their ability to enhance customer experiences, optimize processes, and reduce costs makes them invaluable tools for the mortgage industry. While there are always challenges and questions around the adoption of new technologies, one thing’s for sure: the use of mortgage AI chatbot applications is on the rise.

A 2021 Stratmor Group report found that 85% of lenders surveyed believe that AI chatbots will become a standard tool for mortgage professionals in the next five years. This suggests that AI chatbots are here to stay, and will likely play a larger role in the mortgage industry in the years to come.