We want to tell you a story about how artificial intelligence is quietly revolutionizing the world of personal finance. It’s not the doomsday scenario you might expect – no evil robots here. Instead, AI financial advisors are becoming the go-to choice for millennials and Gen Z looking for affordable, accessible, and personalized financial guidance.

These digital advisors are available 24/7, offering tailored advice based on individual goals and circumstances. They’re not just convenient; they’re also leveling the playing field, making professional financial advice more attainable for younger generations. And, they are building better customer experiences and relationships for banks, lenders, credit unions, and even employers. And the best part? AI advisors keep learning and adapting, getting smarter with every interaction.

So, are you ready to meet your client’s new financial best friend? Let’s explore the rise of AI financial advisors and what it means for the future of money management. Trust us, it’s going to be a game-changer.

The Rise of AI Financial Advisors: How Millennials and Gen Z Are Embracing Digital Financial Advice

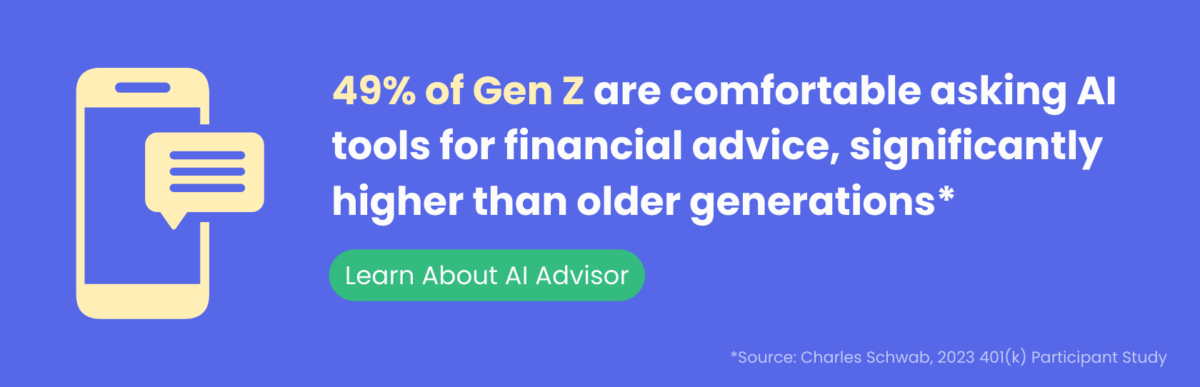

Millennials and Gen Z are all about digital everything. They’ve grown up with technology at their fingertips, so it’s no surprise that they expect the same level of convenience and accessibility when it comes to managing their finances. That’s where AI financial advisors come in. These digital platforms are changing the game, offering personalized financial advice that’s tailored to our unique needs and preferences, bridging the gap between traditional financial institutions and a tech-savvy generation.

The Growing Preference for Digital Communication

Let’s face it, millennials prefer texting over talking on the phone any day. And when it comes to getting financial guidance, they want the same level of convenience and accessibility.

That’s why millennials expect financial advice to be available through digital channels like AI chatbots and conversational AI. They want to be able to get the answers they need, when they need them, without having to schedule a formal meeting or play phone tag.

How AI Financial Advisors Meet the Needs of Younger Generations

AI financial advisors are the perfect solution for millennials and Gen Z. These digital platforms offer 24/7 access to financial guidance so they can get the help they need on their own schedule.

Plus, with features like personalized advice and budgeting apps, AI financial advisors can help them stay on top of their finances and reach their goals.

The Benefits of AI-Powered Financial Advice

One of the most revolutionary aspects of AI-powered financial advice is the level of personalization it offers. Gone are the days of one-size-fits-all financial plans. AI platforms take the time to understand your client’s unique situation:

- Deep Dive into Their Finances: AI analyzes income, spending habits, debts, assets, and financial goals. It doesn’t just look at numbers – it paints a comprehensive picture of your client’s financial landscape.

- Goals Take Center Stage: Whether your client is saving for a dream vacation, planning for retirement, or aiming for financial independence, AI tailors its advice to their specific goals. It prioritizes strategies that will get them where they want to be financially.

- Risk Tolerance in Mind: Not everyone is comfortable with the same level of risk. AI considers risk tolerance when recommending investment options, ensuring your client makes informed decisions that align with their comfort level.

Beyond Personalization: Real-Time Insights and Actionable Advice

The benefits of AI financial advisors extend far beyond personalization. These platforms leverage technology to empower your clients to take control of their finances:

- Seamless Account Integration: Imagine your clients having all their financial accounts – bank accounts, investment portfolios, credit cards – linked to a single platform. AI tools can integrate with their existing accounts, providing a holistic view of their financial health in real-time.

- Up-to-the-Minute Updates: No more scrambling to gather financial information. AI platforms provide real-time updates on their account balances, transaction history, and investment performance. This constant awareness empowers your client to make informed financial decisions, identify spending anomalies, and capitalize on potential opportunities.

- Actionable Recommendations: AI doesn’t just analyze data – it translates insights into actionable advice. Your client will receive personalized recommendations on budgeting strategies, debt repayment plans, and investment options, all tailored to your unique circumstances.

AI financial advisors are more than just automated financial planners. They are intelligent tools that personalize your client’s financial journey, provide real-time insights, and empower them to make informed decisions for a brighter financial future.

More Than Just Consumer Benefits: AI Financial Advisor Benefits for Financial Institutions

While AI financial advisors offer your clients convenience and benefits (especially millennials and Gen Z), for banks, lenders, and credit unions, the importance goes even deeper. Here’s why:

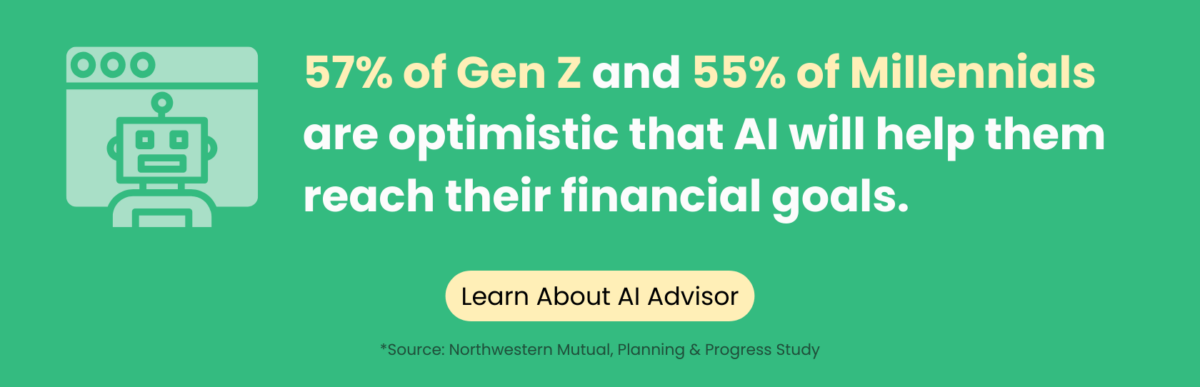

Reaching a Tech-Savvy Generation: Millennials and Gen Z are the future of finance. By offering AI financial advisors, banks can connect with this demographic on their terms – through digital platforms they’re comfortable using. This allows banks to build relationships with these customers early and foster long-term loyalty.

Scalability and Efficiency: Traditional financial advisors can only handle a limited number of clients. AI financial advisors, on the other hand, can serve a vast number of users simultaneously. This allows banks to provide financial guidance to a broader audience without significantly increasing costs.

Data-Driven Customer Insights: AI tools can analyze vast amounts of customer data to understand their financial needs, goals, and risk tolerance. This allows banks to offer personalized financial products and services that are more likely to resonate with each customer.

Increased Customer Engagement: AI financial advisors can proactively engage with customers through personalized advice, budgeting tips, and educational resources. This ongoing engagement keeps customers informed and invested in their financial health, leading to a more positive banking experience.

Improved Customer Acquisition and Retention: By providing accessible and personalized financial guidance, AI financial advisors can help banks attract new customers, particularly millennials and Gen Z, and retain existing ones. This translates to a more competitive advantage and long-term profitability for financial institutions.

In short, AI financial advisors are a win-win for both millennials/Gen Z and financial institutions. They empower younger generations to take control of their finances, while helping banks build stronger customer relationships, acquire new clients, and operate more efficiently.

Key Features of AI Financial Advisors That Appeal to Millennials and Gen Z

Millennials and Gen Z have some pretty high expectations when it comes to financial advice. They want guidance that’s tailored to their unique needs, available whenever they need it, and easy to access and understand.

That’s where AI financial advisors really shine. These platforms offer a range of features that are specifically designed to appeal to younger generations.

Personalized Guidance Based on Individual Circumstances

One of the biggest draws of AI financial advisors is the level of personalized advice they offer. By analyzing income, expenses, and financial goals, these platforms can provide recommendations that are tailored to our unique situation.

For example, let’s say your client is a recent college grad with student loan debt and an entry-level salary. An AI financial advisor might suggest a budget that prioritizes paying down their loans while still allowing for some discretionary spending.

Or, maybe they’re a millennial entrepreneur with a variable income. In that case, the platform might recommend setting aside a larger emergency fund and investing in a diversified portfolio to help manage risk.

24/7 Availability and Convenience

Another key feature that appeals to millennials and Gen Z is the 24/7 availability of AI financial advisors. They’re used to being able to access information and services whenever they need them, and they expect the same level of convenience when it comes to managing our finances.

With an AI financial advisor, your clients can get answers to their questions and access their account information at any time, from anywhere – even if you’re not in the office. No more waiting for business hours or scheduling appointments weeks in advance.

Goal-Setting and Budgeting Tools

AI financial advisors also often have built-in tools for setting and tracking financial goals. Whether they’re saving up for a down payment on a house or trying to pay off credit card debt, these platforms can help your clients create a plan and stay on track.

Some platforms even offer budgeting apps that automatically categorize their spending and alert them when they’re close to going over budget. This can be a game-changer for millennials and Gen Z, who may be juggling multiple financial priorities and need help staying organized.

Integration with Digital Banking Platforms

Finally, many AI financial advisors integrate seamlessly with popular digital banking platforms. This allows users to get a comprehensive view of their finances in one place and makes it easy to track progress toward their goals.

For example, let’s say your client has accounts with multiple banks and credit card companies. With an AI financial advisor that integrates with these platforms, you and your client can see all of their account balances and transactions in one dashboard.

This not only saves time and hassle, but it also helps you and your client make more informed financial decisions. By seeing the big picture of their finances, you both can identify areas where they may need to cut back or adjust their budget to reach their goals.

How AI Financial Advisors Compare to Traditional Human Advisors

Now, we know what you might be thinking. Can an AI financial advisor really provide the same level of guidance and expertise as a human advisor?

There are definitely some key differences to consider.

Cost Comparison: AI vs. Human Advisors

One of the biggest advantages of AI financial advisors is the cost. While human advisors often charge a percentage of assets under management or a high hourly rate to give personal advice, many AI advisors offer their services for a much lower fee or even for free.

For millennials and Gen Z who may be just starting out in their careers and have limited funds to invest, this can be a major selling point. They want to be able to access quality financial advice without breaking the bank.

Of course, it’s important to keep in mind that they may not get the same level of personalized attention or hand-holding with an AI advisor. But for those who are comfortable managing their own finances and just need some guidance and tools to help them stay on track, an AI advisor can be a great choice.

Scope of Services Offered

Another key difference between AI and human advisors is the scope of services they offer. While human advisors can provide a wide range of services, from investment management to estate planning, AI advisors tend to be more focused on specific areas like budgeting, saving, and investing.

This can be both a pro and a con, depending on your client’s needs. If you have a complex financial situation that requires a lot of individualized attention and expertise, a human advisor may be a better fit.

But if your client is looking for some basic guidance and tools to help them manage their money, an AI advisor can be a great option. Plus, with the ability to access their account and get advice 24/7, they can get the help they need when they need it.

Qualifications and Expertise

When it comes to qualifications and expertise, human advisors definitely have the edge. Most certified financial planners have years of education and experience under their belts, and they’re held to strict ethical and professional standards.

AI advisors, on the other hand, are only as good as the algorithms and data they’re based on. While they can certainly provide valuable insights and recommendations, they may not have the same depth of knowledge or ability to provide nuanced advice.

That being said, many AI advisors are developed in collaboration with financial experts and are constantly being updated and improved based on user feedback and market trends. So, while they may not have the same level of expertise as a human advisor, they can still be a valuable resource for those looking for guidance.

Addressing Complex Financial Situations

For complicated financial matters – like having diverse income streams, significant wealth, or special tax situations – your client might find more personalized financial advice helpful and need to work with a real human adviser. They can then get the sophisticated planning and deeper understanding geared towards effective individual solutions that they need.

Similarly, if they’re going through a major life transition, like getting married, having a child, or approaching retirement, a human advisor can provide the emotional support and hand-holding that an AI advisor simply can’t match.

However, for millennials and Gen Z who are just starting out and have relatively straightforward financial needs, an AI advisor can be a great way to get started on the path to financial success.

The Future of Financial Advice: Combining AI and Human Expertise

So, what does the future of financial advice look like? In our opinion, it’s all about combining the best of both worlds – the efficiency and accessibility of AI with the expertise and emotional intelligence of human advisors.

The Complementary Roles of AI and Human Advisors

We envision a future where AI and human advisors work together seamlessly to provide comprehensive, personalized financial guidance. AI can handle the day-to-day tasks like budgeting and portfolio management, freeing up human advisors to focus on the big picture and provide strategic advice.

For example, let’s say your client is working with a human advisor to create a long-term financial plan or savings goals. The advisor can use AI tools to quickly analyze their current financial situation, identify areas for improvement, and generate personalized recommendations.

But, the human advisor can then take that information and provide context and nuance based on their years of experience and understanding of their unique goals and values. They can help them weigh the pros and cons of different options and make decisions that align with their overall financial strategy.

Hybrid Models for Comprehensive Financial Planning

We’ll also see more financial institutions offering hybrid models that combine AI and human advice in a single platform. This could take the form of an AI-powered app that provides basic budgeting and investment guidance, with the option to connect with a human advisor for more complex needs.

Or, it could be a traditional advisory firm that uses AI to streamline processes and provide real-time insights, while still offering the personalized attention and expertise of human advisors.

The key is to find the right balance and use AI to enhance, rather than replace, the value of human advice. By leveraging the strengths of both, we can create a more efficient, effective, and empowering customer experience for everyone.

Adapting to Evolving Consumer Preferences

Of course, as with any industry, the world of financial advice will need to continue to adapt and evolve to meet the changing needs and preferences of consumers. And for millennials and Gen Z, that means prioritizing things like transparency, accessibility, and social responsibility.

They want to work with advisors who are upfront about their fees and incentives, and who use technology to make the planning process more convenient and engaging. They also care about things, like environmental, social, and governance (ESG) investing and want to align our financial choices with their values.

By staying attuned to these preferences and using AI to create more value-aligned and personal financial advice, advisors can build brand loyalty and trust with younger generations. And that, in turn, can help create a more sustainable and impactful financial services industry for years to come.

Key Takeaway:

Millennials and Gen Z are turning to AI financial advisors for personalized, 24/7 advice and customer service. These digital platforms provide tailored recommendations based on unique financial situations, offering tools for budgeting and goal-setting. They’re more affordable than traditional advisors, making professional guidance accessible to younger generations.

Frequently Asked Questions in Relation to AI Financial Advisor

Can AI be your financial advisor?

Yes, AI can give personalized financial advice and help with budgeting, investments, and planning.

Will AI replace Financial Advisors?

No. While AI financial advice helps, it won’t fully replace Certified Financial Planners who handle more complex situations.

What is an AI powered financial coach?

An example of an AI-powered financial coach is a system that provides tailored guidance to achieve goals, based on their personal financial situation.

How is AI being used in finance?

AI enhances investment strategies, customer service chatbots, fraud detection systems, and personal budget tools for better money management.

Conclusion

AI financial advisors are here to stay, and they’re only going to get better. By combining the power of artificial intelligence with the empathy and expertise of human advisors, we can create a future where personalized financial guidance is accessible to everyone, regardless of age or income.

Millennials and Gen Z are leading the charge, embracing these digital tools to take control of their financial futures. And as AI continues to evolve, we can expect even more innovative solutions that make managing money easier, smarter, and more rewarding.

So, whether your client is just starting their financial journey or looking to optimize their investments or get homeownership ready, don’t be afraid to support them with AI financial advisors. They might just be the key to unlocking your client’s financial potential and achieving their dreams.