Mission-driven beginnings

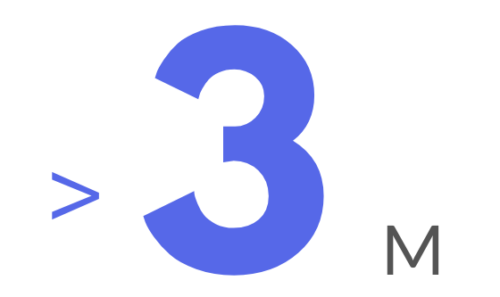

Celebrating 10 years enabling >3 million consumers to conquer their mortgage, auto, student, and personal loan debt.

payments remitted to loan servicers

consumers have used EarnUp

cumulative transactions value

transactions completed

EarnUp is an award-winning financial technology platform that intelligently automates loan debt repayment.

Our founders built EarnUp because they saw financial worries take a toll on their parents.

EarnUp is a consumer-first payment platform.

It was designed to help achieve a goal of providing people with financial tools to easily manage money and improve financial well-being.

According to the Consumer Financial Protection Bureau (CFPB), in 2020 credit card issuers charged $12 billion in late fees. We’d like to see that number plummet to zero.

EarnUp is an award-winning consumer-first financial technology platform that intelligently automates loan payment scheduling.

The EarnUp payments platform makes it easy for people to stay on track with loan payments through its patented technology and predictive analytics. EarnUp manages >$10 billion in loans and has helped more than 3 million people across the U.S. outsmart their loan debt.

EarnUp has received numerous awards, including the HousingWire 2023 Tech100 Mortgage Winners, Forbes Fintech 50, CNBC Upstart 100, and Citi Open Innovation Challenge.

The Financial Pandemic

Americans are more in debt than ever.

If something isn’t done to address this growing financial burden, it could have dire consequences for the overall economy.

The staggering levels of debt, whether it be from student loans, credit card debt, or mortgages, are a cause for concern.

Additionally, individuals must prioritize financial literacy and make informed decisions about their borrowing habits to avoid falling deeper into debt.

Americans Owe*

Disclosures

EarnUp Inc.

2370 Market St Ste 203

San Francisco, CA 94114-1521 USA

800-209-9700

© EarnUp 2025 All Rights Reserved