Emergency Savings Funds: Foundations for Workplace Wellness

Learn why emergency savings funds are critical in today’s world and discover how employers are implementing programs to improve financial wellness.

The only solution that automates flexible debt payoff and savings, eliminates financial duress, and improves overall health and wellness.

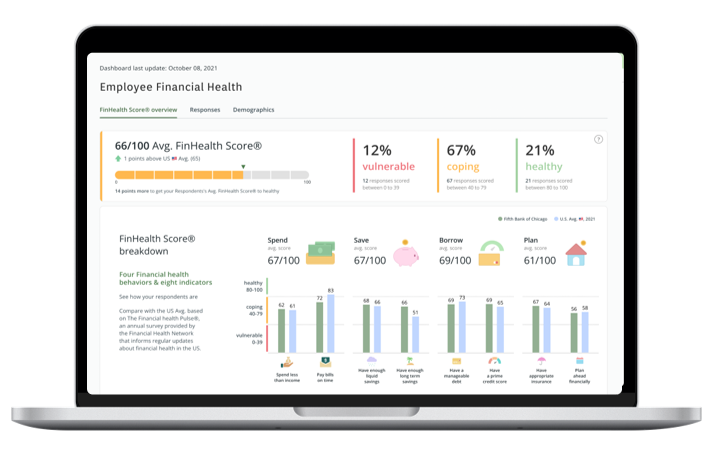

We offer a scientifically developed financial health assessment quiz

Give your workforce the ability to confidentially self-assess and benchmark their financial health to guide their progress.

We provide you anonymized data to track progress, measure benefit adoption, and quantify the impact on the bottom line.

Experience it for yourself.

Your employee’s debt is likely at an all-time high and the impact on your business could be massive.

Lunch & Learn programs alone are not the answer.

Plug in a turnkey benefit that has an immediate impact.

Student loan debt is the second most prevalent form of consumer debt, followed by mortgage.

We can support your pre-tax contribution efforts and your SECURE 2.0 for 401(k) matching programs.

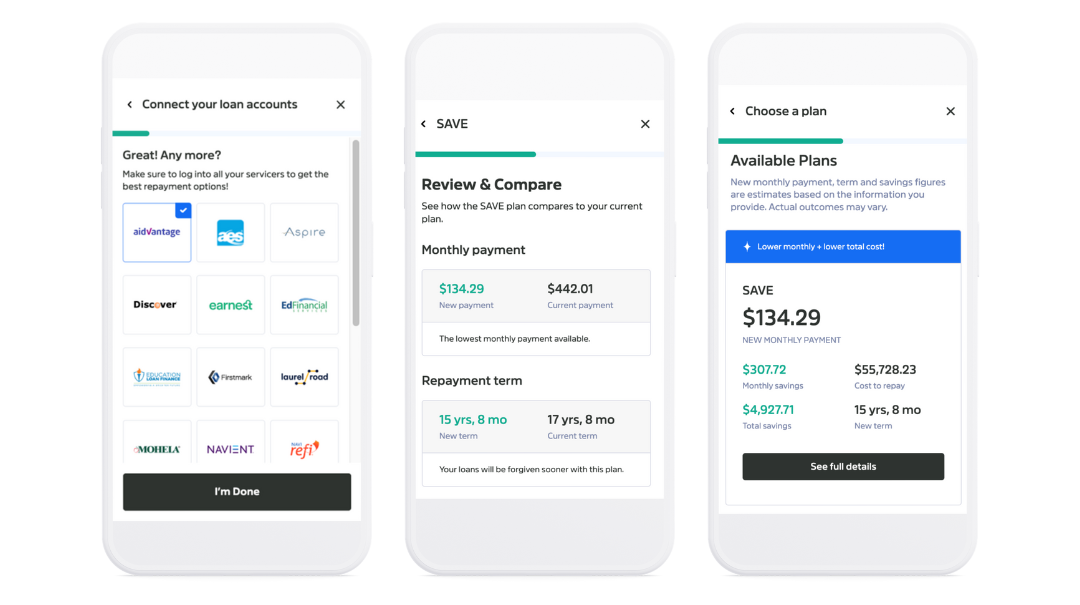

Your workforce deserves to benefit from their education. Unfortunately, it can delay financial goals, like homeownership. Using this tool, your workforce can:

Total solution. On demand tools.

Put mortgage, auto, student, and personal loan payments on autopilot. Paydown loans faster and save money in interest fees.*

Split large, single payments into 2, 3, 4, or 5 automated debits.

Live 1:1 payoff planning sessions to build an automated credit card payoff plan.

Innovative tools to help your workforce optimize their student loan debt with only a few clicks.

Schedule savings deposits on your schedule. Money can be directed toward debt paydown, emergency savings, or financial goals.

Benchmark financial health using a scientifically developed, brief assessment quiz.

Financially stressed employees are often less productive due to distractions and absenteeism.

There is a direct correlation between financial stress and health issues. By addressing financial well-being, employers can potentially reduce healthcare costs and improve the overall health of their workforce.

Employees can embark on a tailored financial fitness plan at any time.

Financial wellness programs add value to an organization's benefits package, making it more attractive to current and potential employees.

Employees appreciate employers who care about their financial well-being. Financial wellness programs can boost job satisfaction and morale.

Your employees are suffering in silence. 8 out of 10 people live paycheck to paycheck. This is not age or tenure specific.

Learn why emergency savings funds are critical in today’s world and discover how employers are implementing programs to improve financial wellness.

Disclosures

*Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

Total solution. On demand tools.

EarnUp Inc.

2370 Market St Ste 203

San Francisco, CA 94114-1521 USA

800-209-9700

© EarnUp 2024 All Rights Reserved