Enhancing Your Borrower Relationship Post Closing: Tips for Lenders

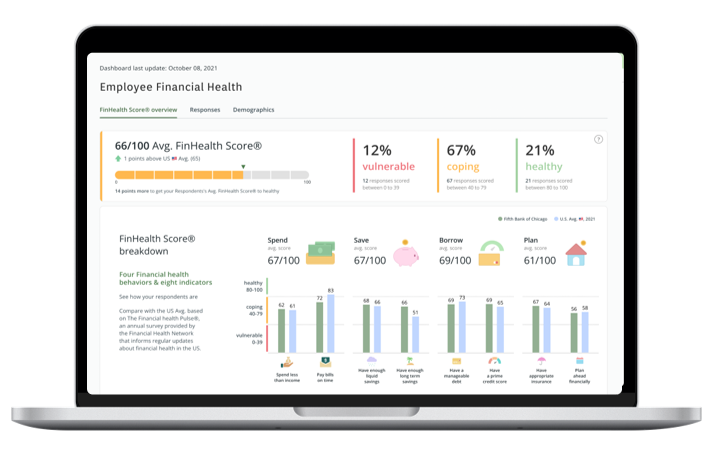

Building a strong Borrower Relationship is key for success in lending. Discover how to move beyond the closing table and nurture trust for lifetime loyalty and profits. Learn how to balance borrower needs and maintain lender success