Emergency Savings Funds: Foundations for Workplace Wellness

Learn why emergency savings funds are critical in today’s world and discover how employers are implementing programs to improve financial wellness.

EarnUp@Work

The only solution that automates flexible debt payoff and savings, eliminates financial duress, and improves overall health and wellness.

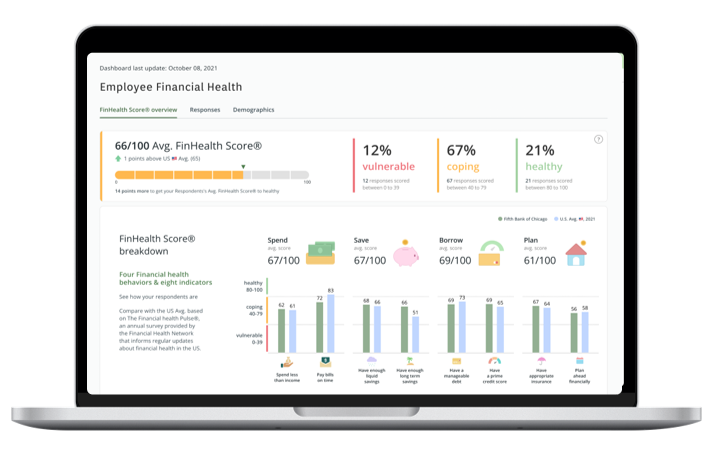

Know the value of your benefits beyond engagement

It’s a win-win.

Your workforce can confidentially benchmark their financial health to measure progress.

You can measure benefit engagement and quantify ROI using anonymized anonymized data.

According to the most recent Experian analysis, at $8,134 Generation X carries the largest credit card balances. Boomers at $6245 & Millennials at $5649 are not far behind.

We can help structure a payoff plan to dig out faster.

Estimate the payoff of your balance

$1,038

$245,571

27 years 9 month

| Month | Monthly Payment | Principal | Interest | Ending Principal |

|---|---|---|---|---|

| 0 | - | - | - | $100,000 |

| 1 | $1,038 | $38 | $1,000 | $99,962 |

| 2 | $1,038 | $38 | $1,000 | $99,924 |

| 3 | $1,038 | $39 | $999 | $99,886 |

| 4 | $1,038 | $39 | $999 | $99,847 |

| 5 | $1,038 | $39 | $998 | $99,807 |

This analysis is an estimate only. This illustrative example demonstrates payoff timelines assuming balance does not increase.

Individual results will vary based on your unique situation.

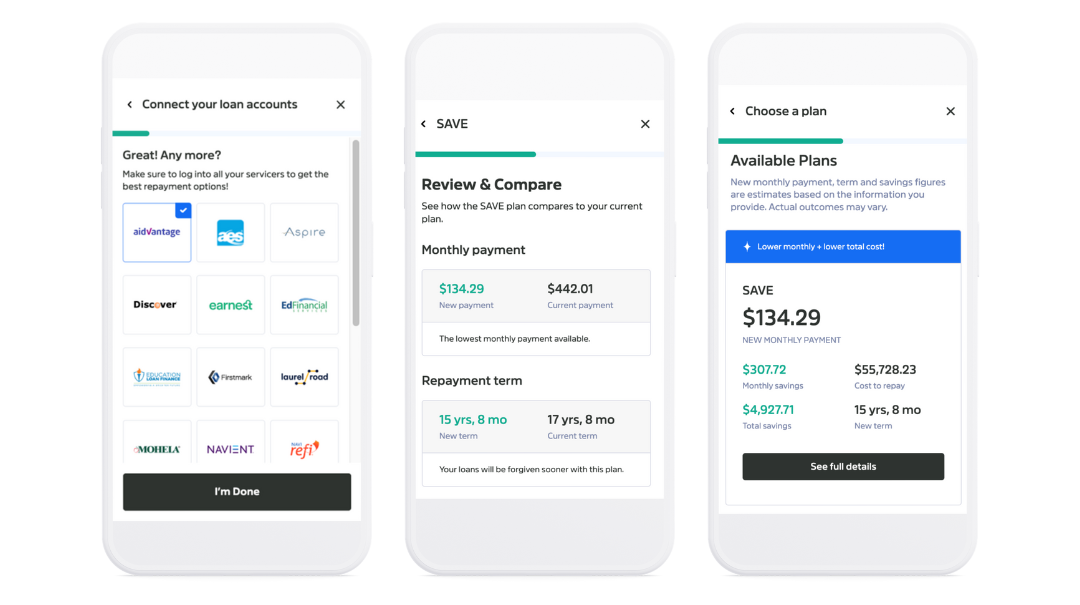

Your workforce deserves to benefit from their eductation. Unfortunately, it can delay financial goals, like homeownership. Using this tool, your workforce can:

Total solution. On demand tools.

Financially stressed employees are often less productive due to distractions and absenteeism.

There is a direct correlation between financial stress and health issues. By addressing financial well-being, employers can potentially reduce healthcare costs and improve the overall health of their workforce.

Employees can embark on a tailored financial fitness plan at any time.

Financial wellness programs add value to an organization's benefits package, making it more attractive to current and potential employees.

Employees appreciate employers who care about their financial well-being. Financial wellness programs can boost job satisfaction and morale.

Your employees are suffering in silence. 8 out of 10 people live paycheck to paycheck. This is not age or tenure specific.

Learn why emergency savings funds are critical in today’s world and discover how employers are implementing programs to improve financial wellness.

Disclosures

*Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.