Powered by

Master Your Money:

Building Credit*

Building Credit for Life's Big Purchases*

Building a strong credit history is akin to constructing a solid foundation for your financial future. Timely debt payments are not just about avoiding late fees; they play a pivotal role in sculpting your credit score, serving as a testament to your reliability as a borrower. In the intricate dance of credits and debits that shapes our financial lives, understanding how making debt payments on time can help you build credit is crucial.

The Importance of On-Time Debt Payments

When it comes to building credit, consistency is key. Each timely payment acts as a brushstroke on the canvas of your credit report, gradually painting you as more trustworthy in the eyes of lenders. This trust translates into better interest rates and terms down the line—potentially saving you thousands over the lifetime of loans.

But how does one ensure that every payment punctuates their commitment to fiscal responsibility? Beyond mere discipline lies smart automation and strategic planning—areas where tools like MyEarnUp shine brightly.

10 Tips for Building Credit:*

- Always Pay On Time: Set reminders or automate payments through services like MyEarnUp to never miss due dates.

- Maintain Low Balances: Keeping balances low compared to your total available credit demonstrates responsible usage.

- Diversify Your Credit Mix: A mix of revolving credit (credit cards) and installment loans (auto or student loans) can reflect well on your ability to manage different types of debts.

- Limit New Credit Applications: Each application can temporarily lower your score; apply sparingly.

- Monitor Your Credit Report Regularly: Ensure accuracy by checking reports from all three major bureaus annually at minimum.

- Pay More Than The Minimum: When possible, paying more than what’s due reduces overall interest costs while demonstrating good money management skills.

- Become an Authorized User: Being added onto someone else’s account with good standing can boost yours too—but tread carefully!

- Consider A Secured Credit Card: If starting out or rebuilding, secured cards require cash collateral but function like regular ones in helping establish history.

- Increase Your Limits Cautiously: Higher limits improve utilization ratios but resist temptation—spend wisely!

- Stay Patient And Persistent: Building or repairing credit doesn’t happen overnight; maintain consistent habits over time.

Boost Your Credit Score* with MyEarnUp

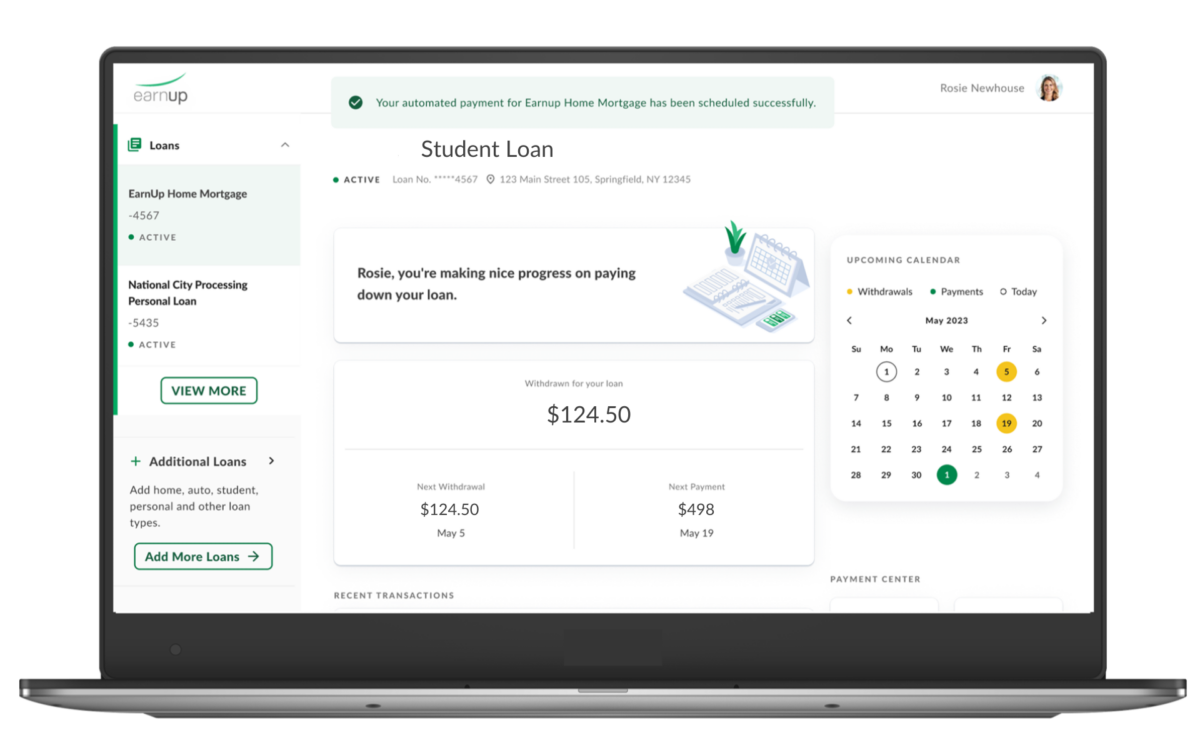

MyEarnUp can be your secret weapon in the fight for a better credit score so you can get better loan terms, lower interest rates, and ultimately, greater financial freedom. Here’s how it helps:

- Tackle Debt Strategically: MyEarnUp can help you create a personalized repayment plan. By prioritizing high-interest debts like credit cards, you can save money and improve your credit utilization ratio, a major factor in credit scores.

- Don’t Miss a Payment Again: Stay on top of your debt with MyEarnUp’s automated withdrawals and ability to manage all your loans from one platform. On-time payments are crucial for building a positive credit history.

- Align Your Paydays & Debt Repayment: Lets you specify your payday frequency, whether weekly, bi-weekly, or monthly, and craft an effective repayment strategy that aligns with those paydays.

Disclosures

¹Interest and loan term reduction are calculated based on the requirement of additional deductions and payments made towards the loan principal over the life of the loan. The loan must be paid to completion with no defaults or payment errors on the account in order to realize the savings. Savings may vary based on your unique EarnUp Program.

² In some circumstances, loans may require that outstanding items, such as escrow (for property taxes and insurance), late fees, or past-due payments, must be paid before funds can be applied to principal. These are determined based on the terms of your specific loan and are applied by your loan servicer.

³ Testimonials are individual experiences and results vary.

*NOT A CREDIT REPAIR ORGANIZATION OR CONTRACT. EarnUp is not a credit repair organization, or similarly regulated organization under other applicable law and does not provide any form of credit repair advice or counseling. EarnUp is not a lender or provider of credit cards. EarnUp helps users to manage their debt, minimize interest fees, or automate smarter budgeting.

** Money transmission services provided by EarnUp partner financial institutions. The applicable EarnUp partner financial institution is the only entity authorized to initiate or execute payments and transfers on your behalf. At no time will EarnUp receive, control, or hold your funds.

Copyright © 2024, EarnUp Inc.